Summary

We propose a model for an insurance loss index and the claims process of a single insurance company holding a fraction of the total number of contracts that captures both ordinary losses and losses due to catastrophes. In this model we price a catastrophe derivative by the method of utility indifference pricing. The associated stochastic optimization problem is treated by techniques for piecewise deterministic Markov processes. A numerical study illustrates our results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

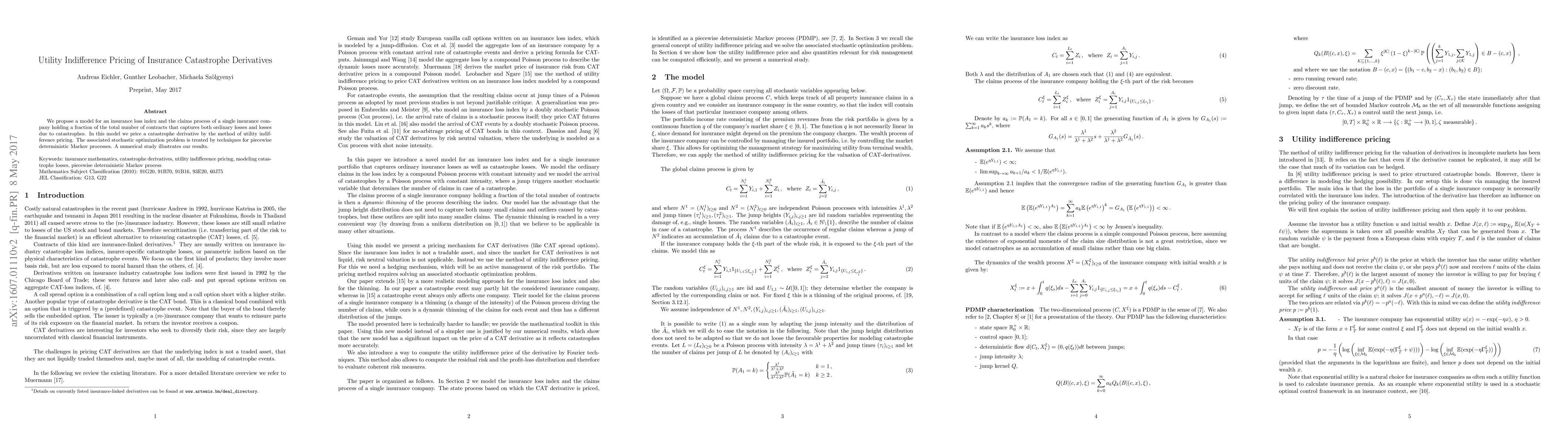

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)