Summary

We consider a utility maximization problem in a broad class of markets. Apart from traditional semimartingale markets, our class of markets includes processes with long memory, fractional Brownian motion and related processes, and, in general, Gaussian processes satisfying certain regularity conditions on their covariance functions. Our choice of markets is motivated by the well-known phenomena of the so-called "constant" and "variable depth" memory observed in real world price processes, for which fractional and multifractional models are the most adequate descriptions. We introduce the notion of a Wiener-transformable Gaussian process, and give examples of such processes, and their representations. The representation for the solution of the utility maximization problem in our specific setting is presented for various utility functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

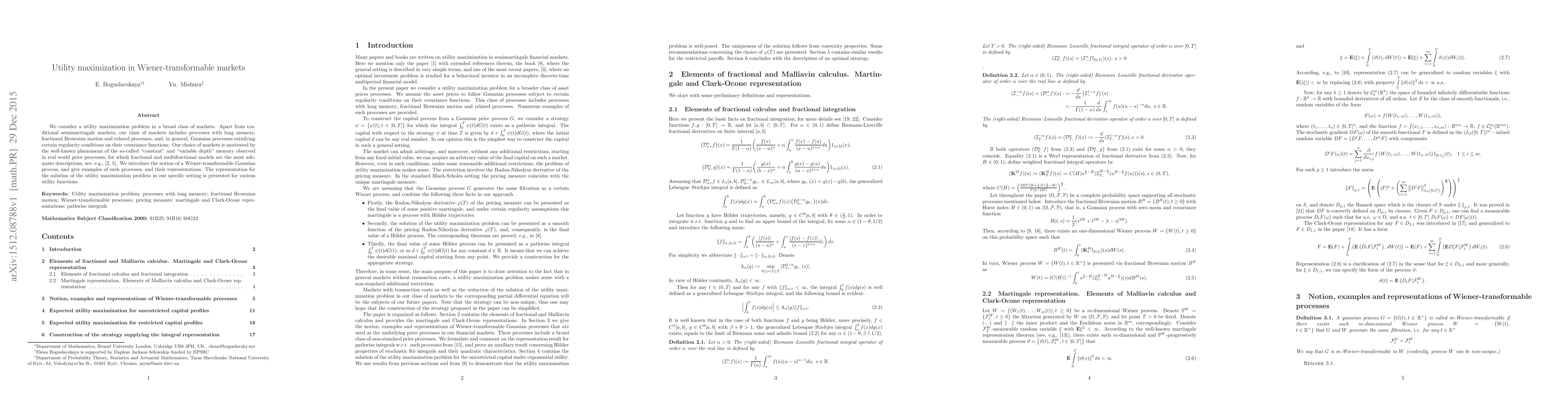

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)