Authors

Summary

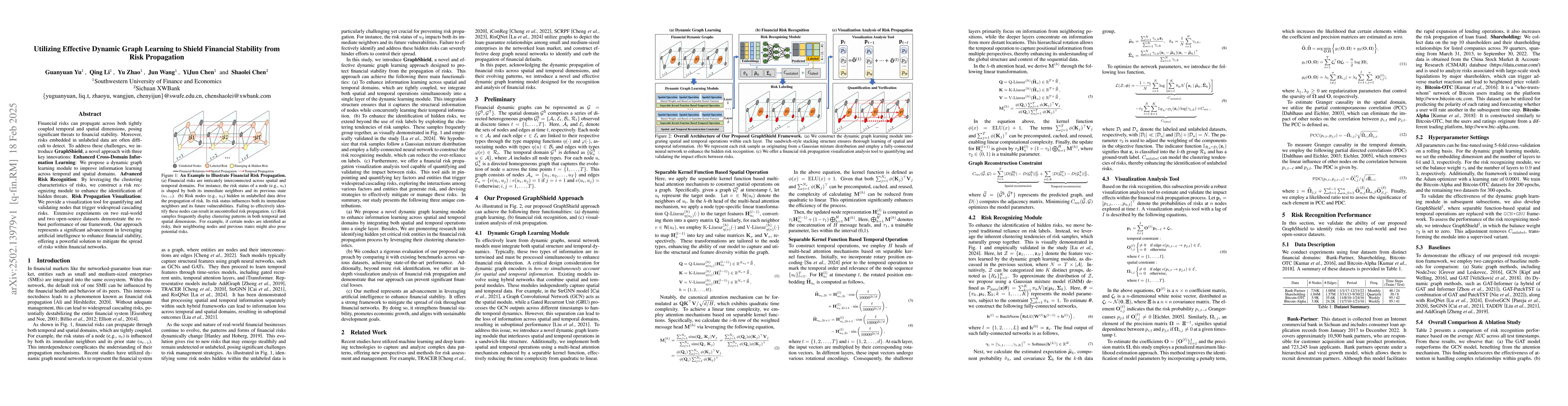

Financial risks can propagate across both tightly coupled temporal and spatial dimensions, posing significant threats to financial stability. Moreover, risks embedded in unlabeled data are often difficult to detect. To address these challenges, we introduce GraphShield, a novel approach with three key innovations: Enhanced Cross-Domain Infor mation Learning: We propose a dynamic graph learning module to improve information learning across temporal and spatial domains. Advanced Risk Recognition: By leveraging the clustering characteristics of risks, we construct a risk recognizing module to enhance the identification of hidden threats. Risk Propagation Visualization: We provide a visualization tool for quantifying and validating nodes that trigger widespread cascading risks. Extensive experiments on two real-world and two open-source datasets demonstrate the robust performance of our framework. Our approach represents a significant advancement in leveraging artificial intelligence to enhance financial stability, offering a powerful solution to mitigate the spread of risks within financial networks.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces GraphShield, a dynamic graph learning model that enhances information learning across temporal and spatial domains, improves hidden risk recognition, and visualizes risk propagation processes using a visualization analysis tool.

Key Results

- GraphShield outperforms static graph methods and other dynamic graph methods in risk detection performance, particularly as the proportion of unlabeled data increases.

- GraphShield maintains an average performance advantage of over 6% compared to GraphShield‡ as the proportion of unlabeled data rises from 40% to 90%.

- Hyperparameter sensitivity analysis demonstrates that embedding dimensions and layer numbers significantly enhance AUC, with optimal settings being an embedding dimension of 64 and a layer number of 3.

- The balance weight τ3 in the semi-supervised risk detecting module shows the most substantial improvement in AUC, increasing from approximately 0.7 to 0.9, underscoring the importance of the supervised constraint Clabel in boosting model performance.

Significance

This research is significant as it presents an innovative and effective dynamic graph learning model, GraphShield, designed to protect financial stability against risk propagation. Its successful deployment at an Internet commercial bank in Sichuan demonstrates tangible impact, and plans are underway to expand its use in critical sectors such as supply chain finance and banking risk management.

Technical Contribution

GraphShield's technical contribution lies in its dynamic graph learning module, which enhances the integration of spatial and temporal information, leading to better risk detection.

Novelty

GraphShield's novelty stems from its comprehensive approach to financial risk management, combining dynamic graph learning, advanced risk recognition, and visualization tools to address the challenges of hidden risks and temporal-spatial risk propagation.

Limitations

- The paper does not explicitly discuss limitations of the proposed method.

- The study's focus on financial datasets may limit the generalizability of findings to other domains.

Future Work

- Further research could explore the application of GraphShield in other financial domains beyond those tested.

- Investigating the model's performance with real-time data feeds could provide insights into its applicability in rapidly changing financial environments.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDynamic graph neural networks for enhanced volatility prediction in financial markets

Nneka Umeorah, Pulikandala Nithish Kumar, Alex Alochukwu

Robust Graph Neural Networks for Stability Analysis in Dynamic Networks

Yue Liu, Xin Zhang, Zhen Xu et al.

Company-as-Tribe: Company Financial Risk Assessment on Tribe-Style Graph with Hierarchical Graph Neural Networks

Xueqi Cheng, Huawei Shen, Xiaoqian Sun et al.

Smart Face Shield: A Sensor-Based Wearable Face Shield Utilizing Computer Vision Algorithms

Manuel Luis C. Delos Santos, Ronaldo S. Tinio, Darwin B. Diaz et al.

No citations found for this paper.

Comments (0)