Authors

Summary

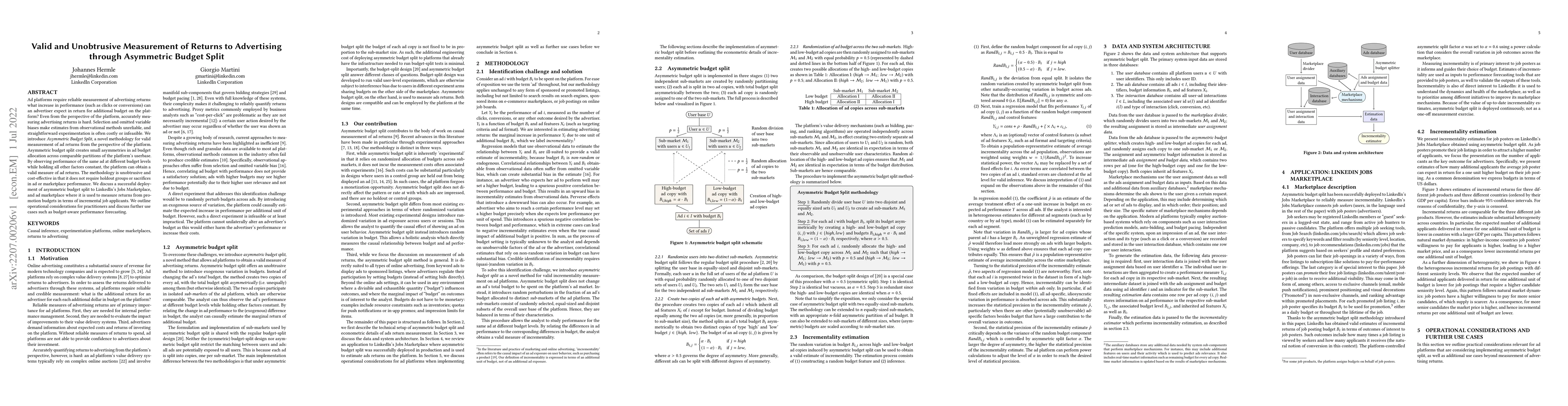

Ad platforms require reliable measurement of advertising returns: what increase in performance (such as clicks or conversions) can an advertiser expect in return for additional budget on the platform? Even from the perspective of the platform, accurately measuring advertising returns is hard. Selection and omitted variable biases make estimates from observational methods unreliable, and straightforward experimentation is often costly or infeasible. We introduce Asymmetric Budget Split, a novel methodology for valid measurement of ad returns from the perspective of the platform. Asymmetric budget split creates small asymmetries in ad budget allocation across comparable partitions of the platform's userbase. By observing performance of the same ad at different budget levels while holding all other factors constant, the platform can obtain a valid measure of ad returns. The methodology is unobtrusive and cost-effective in that it does not require holdout groups or sacrifices in ad or marketplace performance. We discuss a successful deployment of asymmetric budget split to LinkedIn's Jobs Marketplace, an ad marketplace where it is used to measure returns from promotion budgets in terms of incremental job applicants. We outline operational considerations for practitioners and discuss further use cases such as budget-aware performance forecasting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-channel Budget Coordination for Online Advertising System

Wei Ning, Dehong Gao, Libin Yang et al.

An Adaptable Budget Planner for Enhancing Budget-Constrained Auto-Bidding in Online Advertising

Jian Xu, Tianyu Wang, Bo Zheng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)