Summary

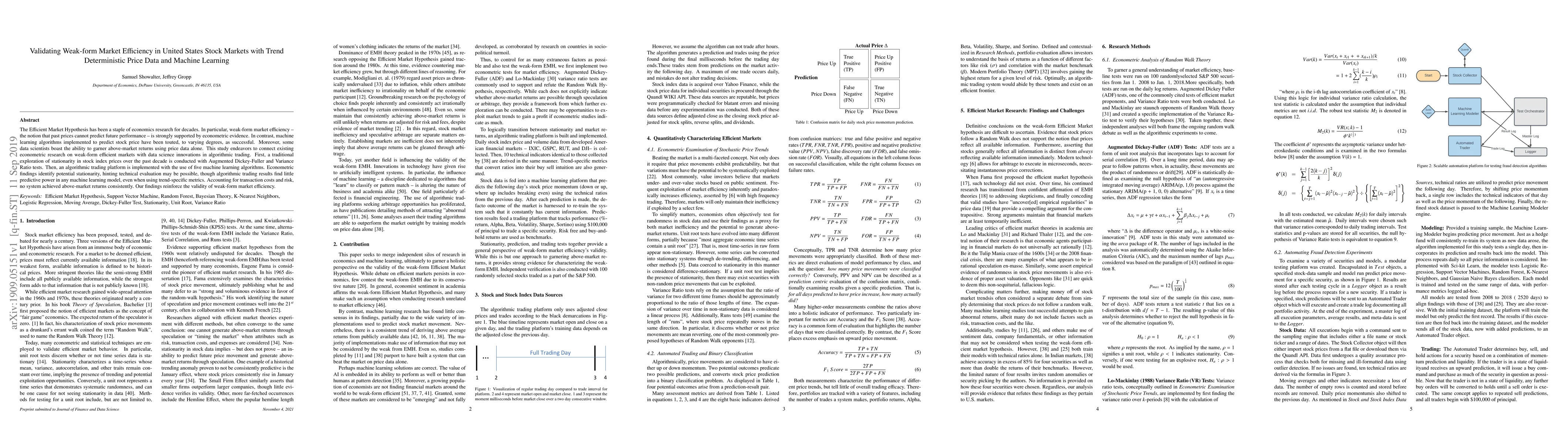

The Efficient Market Hypothesis has been a staple of economics research for decades. In particular, weak-form market efficiency -- the notion that past prices cannot predict future performance -- is strongly supported by econometric evidence. In contrast, machine learning algorithms implemented to predict stock price have been touted, to varying degrees, as successful. Moreover, some data scientists boast the ability to garner above-market returns using price data alone. This study endeavors to connect existing econometric research on weak-form efficient markets with data science innovations in algorithmic trading. First, a traditional exploration of stationarity in stock index prices over the past decade is conducted with Augmented Dickey-Fuller and Variance Ratio tests. Then, an algorithmic trading platform is implemented with the use of five machine learning algorithms. Econometric findings identify potential stationarity, hinting technical evaluation may be possible, though algorithmic trading results find little predictive power in any machine learning model, even when using trend-specific metrics. Accounting for transaction costs and risk, no system achieved above-market returns consistently. Our findings reinforce the validity of weak-form market efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalysis of market efficiency in main stock markets: using Karman-Filter as an approach

Beier Liu, Haiyun Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)