Authors

Summary

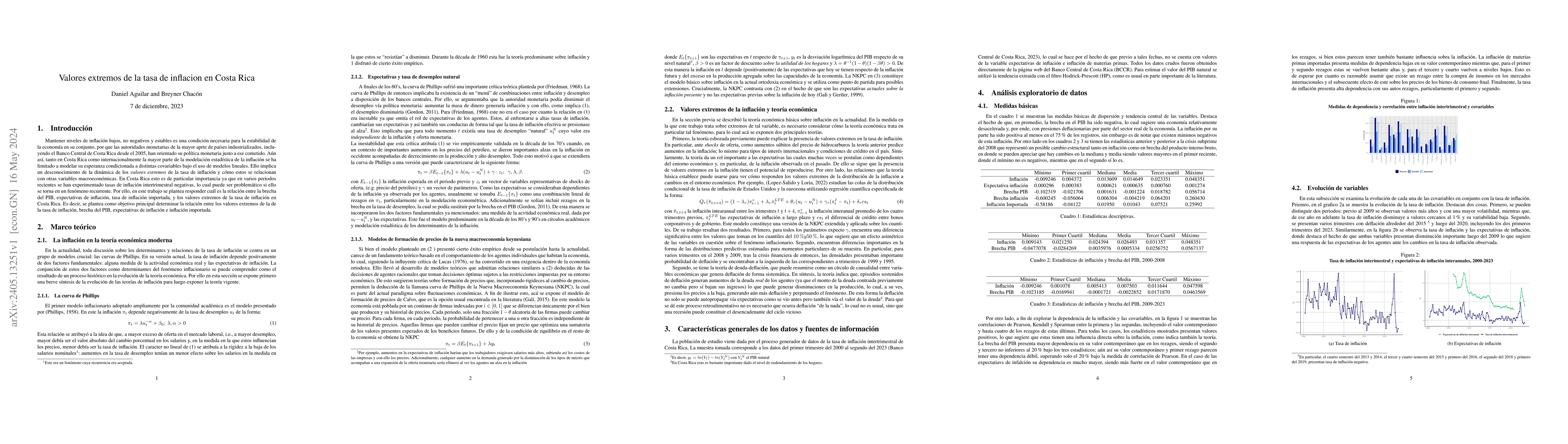

Maintaining low, non-negative and stable inflation levels is a necessary condition for the stability of the economy as a whole, because the monetary authorities of most industrialized countries, including the Central Bank of Costa Rica since 2005, they have oriented their monetary policy precisely to that task. Still Thus, both in Costa Rica and internationally, most of the statistical modeling of inflation has been limited to modeling their expectancy conditional on different covariates using linear models. This implies a lack of knowledge of the dynamics of the extreme values of the inflation rate and how these are related with other macroeconomic variables. In Costa Rica this is of particular importance since in several periods Negative quarter-on-quarter inflation rates have recently been experienced, which can be problematic if this becomes a recurring phenomenon. Therefore, in this work we propose to answer what is the relationship between the gap of GDP, inflation expectations, imported inflation rate, and the extreme values of the inflation rate in Costa Rica. That is, the main objective is to determine the relationship between the extreme values of the the inflation rate, GDP gap, inflation expectations and imported inflation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)