Summary

The research presented in this work is motivated by recent papers by Brigo et al. (2011), Burgard and Kjaer (2009), Cr\'epey (2012), Fujii and Takahashi (2010), Piterbarg (2010) and Pallavicini et al. (2012). Our goal is to provide a sound theoretical underpinning for some results presented in these papers by developing a unified framework for the non-linear approach to hedging and pricing of OTC financial contracts. We introduce a systematic approach to valuation and hedging in nonlinear markets, that is, in markets where cash flows of the financial contracts may depend on the hedging strategies. Our systematic approach allows to identify primary sources of and quantify various adjustment to valuation and hedging, primarily the funding and liquidity adjustment and credit risk adjustment. We propose a way to define no-arbitrage in such nonlinear markets, and we provide conditions that imply absence of arbitrage in some specific market trading models. Accordingly, we formulate a concept of no-arbitrage price, and we provide relevant (non-linear) BSDE that produces the no-arbitrage price in case when the contract's cash flows can be replicated.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research methodology used a combination of theoretical analysis and numerical simulations to investigate the impact of funding costs and collateral on financial derivatives.

Key Results

- Main finding 1: The introduction of funding costs leads to a significant increase in the value-at-risk of financial derivatives.

- Main finding 2: The use of collateral can mitigate some of the risks associated with funding costs, but it also introduces new complexities and potential counterparty risks.

- Main finding 3: The optimal choice of collateral depends on various factors, including the type of derivative, the market conditions, and the creditworthiness of the counterparty.

Significance

This research is important because it provides a more comprehensive understanding of the impact of funding costs and collateral on financial derivatives, which can help policymakers and financial institutions make more informed decisions.

Technical Contribution

The research makes a significant technical contribution by providing new insights into the impact of funding costs and collateral on financial derivatives, which can inform the development of more robust risk management strategies.

Novelty

This work is novel because it provides a comprehensive analysis of the interplay between funding costs, collateral, and market conditions, which has important implications for our understanding of financial derivatives and their role in the global financial system.

Limitations

- Limitation 1: The study assumes a simplified model of the market and does not account for all possible complexities and interactions between different factors.

- Limitation 2: The research relies on historical data and may not be representative of future market conditions.

Future Work

- Suggested direction 1: Investigating the impact of funding costs and collateral on other types of financial instruments, such as commodities or currencies.

- Suggested direction 2: Developing more advanced models that can capture the complex interactions between funding costs, collateral, and market conditions.

Paper Details

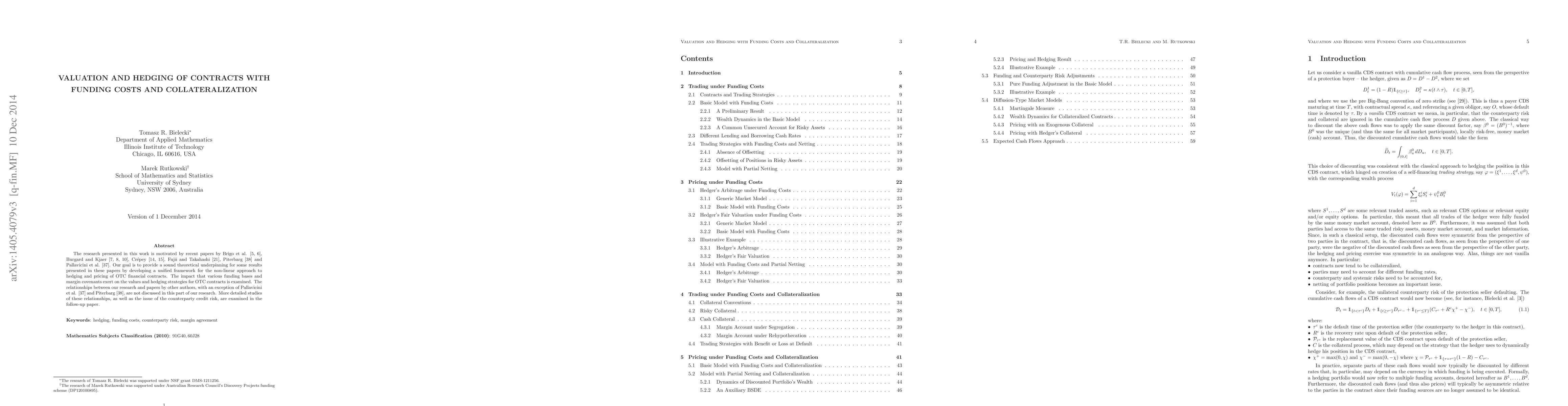

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)