Summary

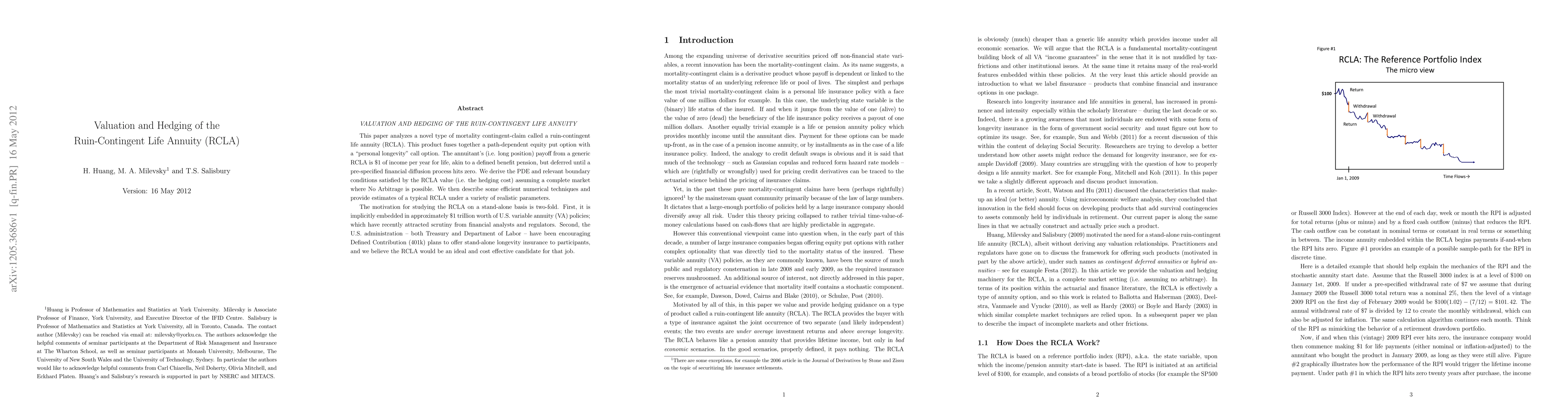

This paper analyzes a novel type of mortality contingent-claim called a ruin-contingent life annuity (RCLA). This product fuses together a path-dependent equity put option with a "personal longevity" call option. The annuitant's (i.e. long position) payoff from a generic RCLA is \$1 of income per year for life, akin to a defined benefit pension, but deferred until a pre-specified financial diffusion process hits zero. We derive the PDE and relevant boundary conditions satisfied by the RCLA value (i.e. the hedging cost) assuming a complete market where No Arbitrage is possible. We then describe some efficient numerical techniques and provide estimates of a typical RCLA under a variety of realistic parameters. The motivation for studying the RCLA on a stand-alone basis is two-fold. First, it is implicitly embedded in approximately \$1 trillion worth of U.S. variable annuity (VA) policies; which have recently attracted scrutiny from financial analysts and regulators. Second, the U.S. administration - both Treasury and Department of Labor - have been encouraging Defined Contribution (401k) plans to offer stand-alone longevity insurance to participants, and we believe the RCLA would be an ideal and cost effective candidate for that job.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLife cycle insurance, bequest motives and annuity loads

Pavel V. Shevchenko, Aleksandar Arandjelović, Geoffrey Kingston

| Title | Authors | Year | Actions |

|---|

Comments (0)