Summary

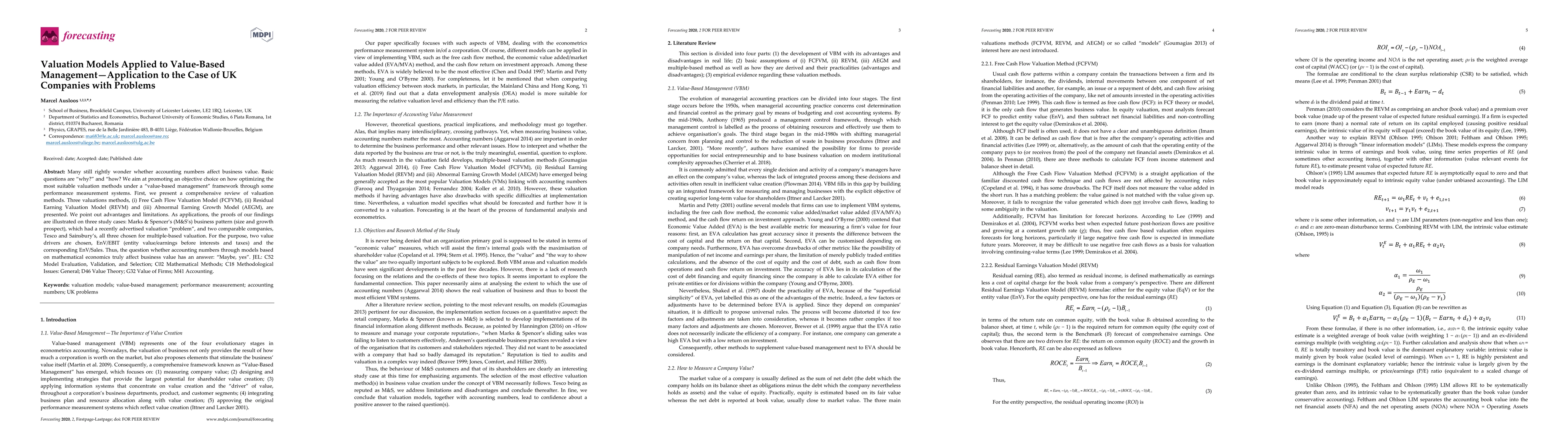

Many still rightly wonder whether accounting numbers affect business value. Basic questions are why? and how? I aim at promoting an objective choice on how optimizing the most suitable valuation methods under a value-based management framework through some performance measurement systems. First, I present a comprehensive review of valuation methods. Three valuations methods, (i) Free Cash Flow Valuation Model (FCFVM), (ii) Residual Earning Valuation Model (REVM) and (iii) Abnormal Earning Growth Model (AEGM), are presented. I point out to advantages and limitations. As applications, the proofs of the findings are illustrated on three study cases: Marks & Spencer's business pattern (size and growth prospect), which had a recently advertised valuation problem, and two comparable companies, Tesco and Sainsbury's, all three chosen for multiple-based valuation. For the purpose, two value drivers are chosen, EnV/EBIT (entity value/earnings before interests and taxes) and the corresponding EnV/Sales. Thus, the question whether accounting numbers through models based on mathematical economics truly affect business value has an answer: Maybe, yes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIT companies: the specifics of social networks valuation

O. A. Malafeyev, K. V. Yupatova, V. S. Lipatnikov et al.

Energy-Based Learning for Cooperative Games, with Applications to Valuation Problems in Machine Learning

Yatao Bian, Andreas Krause, Yu Rong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)