Summary

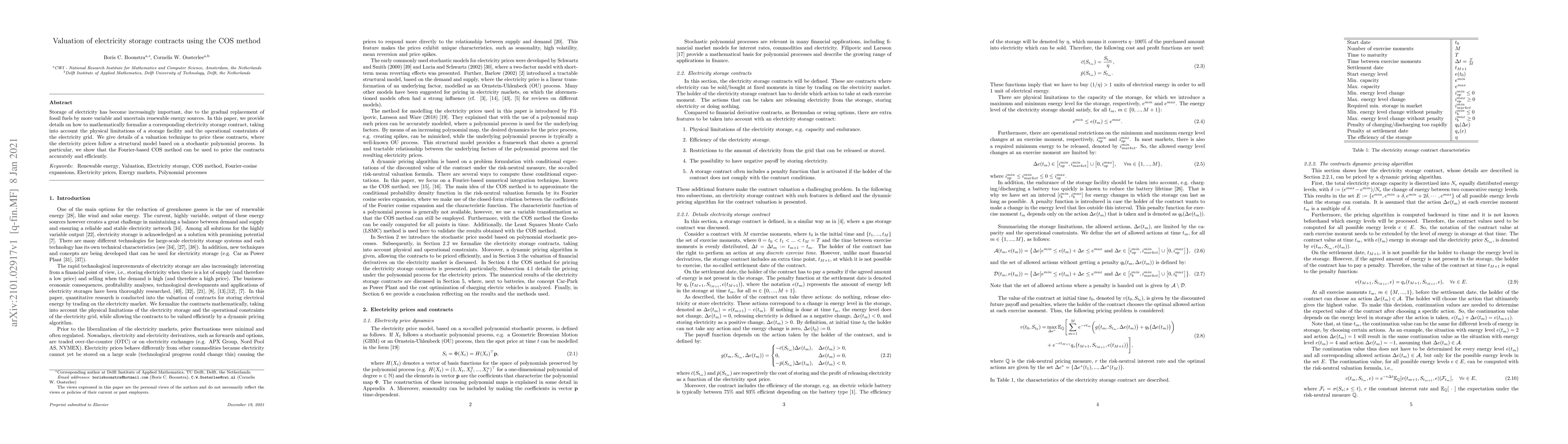

Storage of electricity has become increasingly important, due to the gradual replacement of fossil fuels by more variable and uncertain renewable energy sources. In this paper, we provide details on how to mathematically formalize a corresponding electricity storage contract, taking into account the physical limitations of a storage facility and the operational constraints of the electricity grid. We give details of a valuation technique to price these contracts, where the electricity prices follow a structural model based on a stochastic polynomial process. In particular, we show that the Fourier-based COS method can be used to price the contracts accurately and efficiently.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Operation and Valuation of Electricity Storages

Jean-Philippe Chancelier, François Pacaud, Teemu Pennanen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)