Authors

Summary

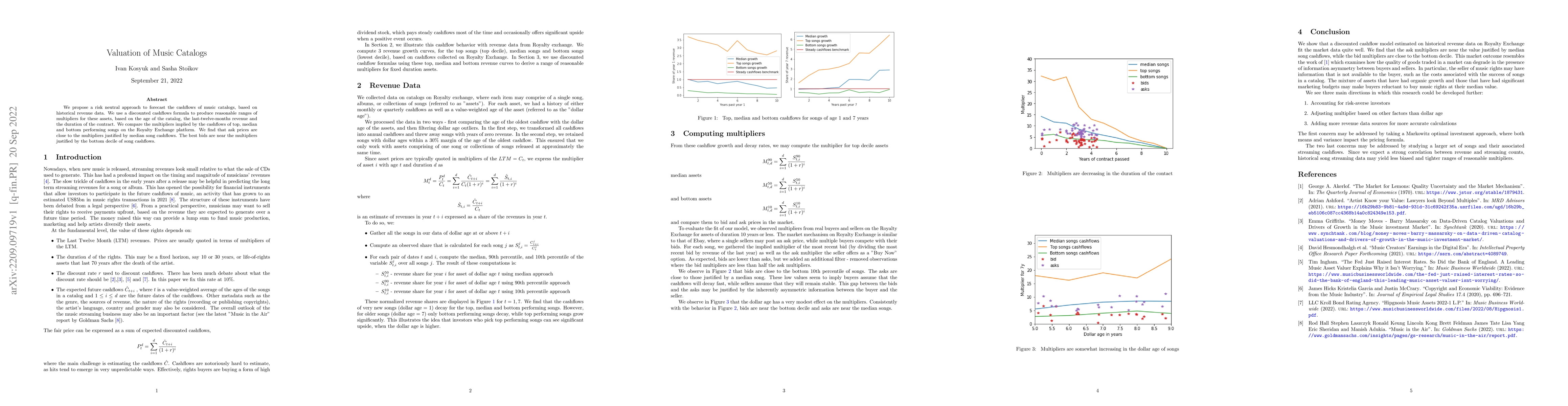

We propose a risk neutral approach to forecast the cashflows of music catalogs, based on historical revenue data. We use a discounted cashflows formula to produce reasonable ranges of multipliers for these assets, based on the age of the catalog, the last-twelve-months revenue and the duration of the contract. We compare the multipliers implied by the cashflows of top, median and bottom performing songs on the Royalty Exchange platform. We find that ask prices are close to the multipliers justified by median song cashflows. The best bids are near the multipliers justified by the bottom decile of song cashflows.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)