Summary

In this paper we present a numerical valuation of variable annuities with combined Guaranteed Minimum Withdrawal Benefit (GMWB) and Guaranteed Minimum Death Benefit (GMDB) under optimal policyholder behaviour solved as an optimal stochastic control problem. This product simultaneously deals with financial risk, mortality risk and human behaviour. We assume that market is complete in financial risk and mortality risk is completely diversified by selling enough policies and thus the annuity price can be expressed as appropriate expectation. The computing engine employed to solve the optimal stochastic control problem is based on a robust and efficient Gauss-Hermite quadrature method with cubic spline. We present results for three different types of death benefit and show that, under the optimal policyholder behaviour, adding the premium for the death benefit on top of the GMWB can be problematic for contracts with long maturities if the continuous fee structure is kept, which is ordinarily assumed for a GMWB contract. In fact for some long maturities it can be shown that the fee cannot be charged as any proportion of the account value -- there is no solution to match the initial premium with the fair annuity price. On the other hand, the extra fee due to adding the death benefit can be charged upfront or in periodic instalment of fixed amount, and it is cheaper than buying a separate life insurance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

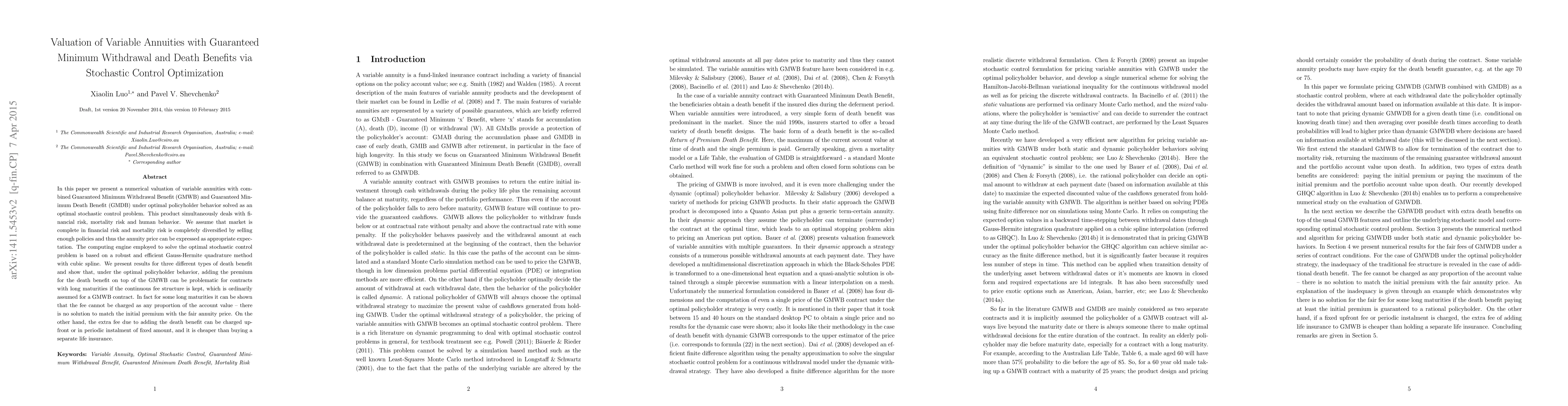

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersValuation of general GMWB annuities in a low interest rate environment

Claudio Fontana, Francesco Rotondi

Enhancing Valuation of Variable Annuities in L\'evy Models with Stochastic Interest Rate

Ludovic Goudenège, Andrea Molent, Xiao Wei et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)