Authors

Summary

Designing dynamic portfolio insurance strategies under market conditions switching between two or more regimes is a challenging task in financial economics. Recently, a promising approach employing the value-at-risk (VaR) measure to assign weights to risky and riskless assets has been proposed in [Jiang C., Ma Y. and An Y. "The effectiveness of the VaR-based portfolio insurance strategy: An empirical analysis" , International Review of Financial Analysis 18(4) (2009): 185-197]. In their study, the risky asset follows a geometric Brownian motion with constant drift and diffusion coefficients. In this paper, we first extend their idea to a regime-switching framework in which the expected return of the risky asset and its volatility depend on an unobservable Markovian term which describes the cyclical nature of asset returns in modern financial markets. We then analyze and compare the resulting VaR-based portfolio insurance (VBPI) strategy with the well-known constant proportion portfolio insurance (CPPI) strategy. In this respect, we employ a variety of performance evaluation criteria such as Sharpe, Omega and Kappa ratios to compare the two methods. Our results indicate that the CPPI strategy has a better risk-return tradeoff in most of the scenarios analyzed and maintains a relatively stable return profile for the resulting portfolio at the maturity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

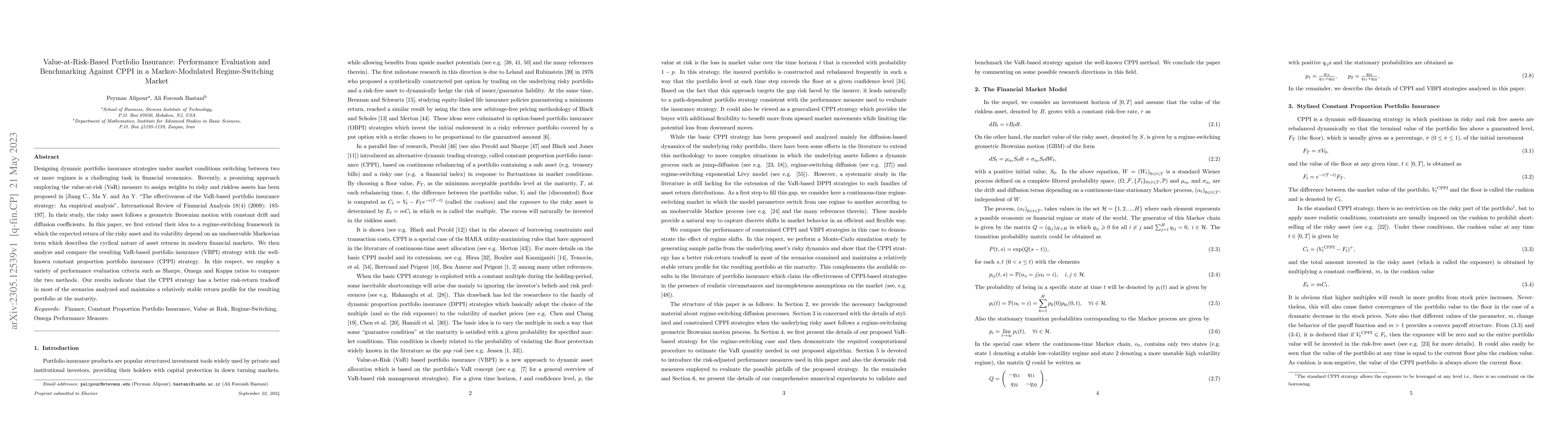

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)