Summary

Value-at-Risk (VaR) is an institutional measure of risk favored by financial regulators. VaR may be interpreted as a quantile of future portfolio values conditional on the information available, where the most common quantile used is 95%. Here we demonstrate Conditional Autoregressive Value at Risk, first introduced by Engle, Manganelli (2001). CAViaR suggests that negative/positive returns are not i.i.d., and that there is significant autocorrelation. The model is tested using data from 1986- 1999 and 1999-2009 for GM, IBM, XOM, SPX, and then validated via the dynamic quantile test. Results suggest that the tails (upper/lower quantile) of a distribution of returns behave differently than the core.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

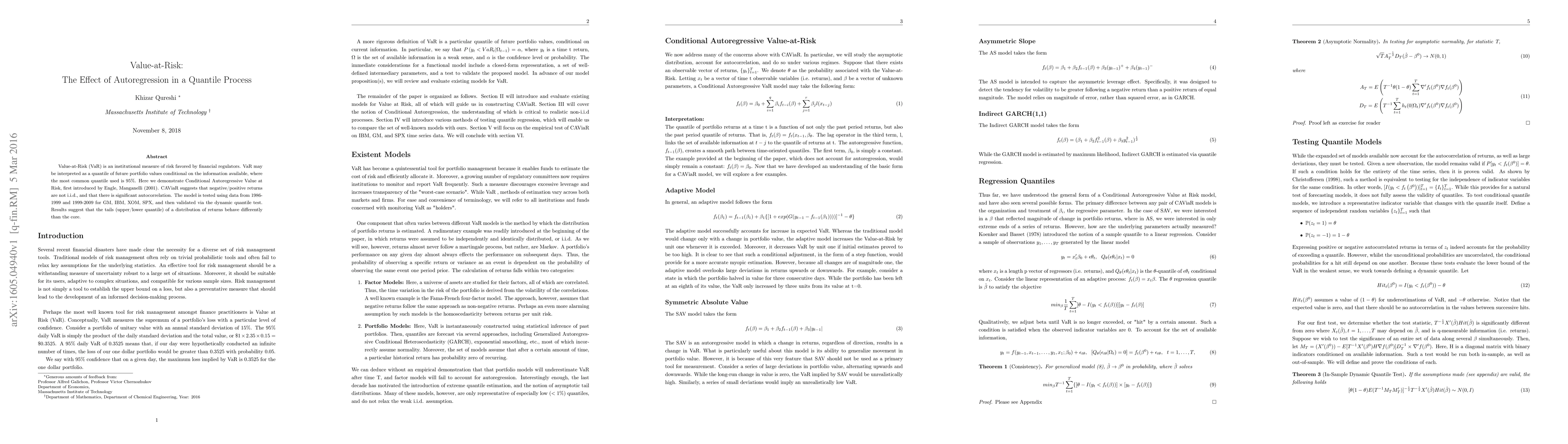

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian joint quantile autoregression

Jorge Castillo-Mateo, Alan E. Gelfand, Jesús Asín et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)