Authors

Summary

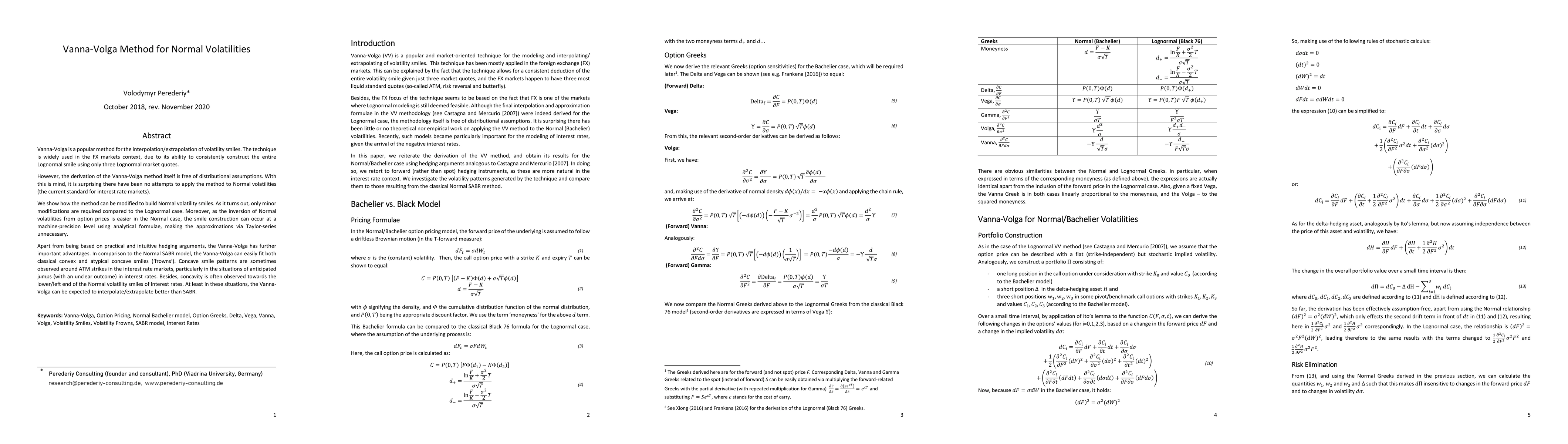

Vanna-Volga is a popular method for the interpolation/extrapolation of volatility smiles. The technique is widely used in the FX markets context, due to its ability to consistently construct the entire Lognormal smile using only three Lognormal market quotes. However, the derivation of the Vanna-Volga method itself is free of distributional assumptions. With this is mind, it is surprising there have been no attempts to apply the method to Normal volatilities (the current standard for interest rate markets). We show how the method can be modified to build Normal volatility smiles. As it turns out, only minor modifications are required compared to the Lognormal case. Moreover, as the inversion of Normal volatilities from option prices is easier in the Normal case, the smile construction can occur at a machine-precision level using analytical formulae, making the approximations via Taylor-series unnecessary. Apart from being based on practical and intuitive hedging arguments, the Vanna-Volga has further important advantages. In comparison to the Normal SABR model, the Vanna-Volga can easily fit both classical convex and atypical concave smiles (frowns). Concave smile patterns are sometimes observed around ATM strikes in the interest rate markets, particularly in the situations of anticipated jumps (with an unclear outcome) in interest rates. Besides, concavity is often observed towards the lower/left end of the Normal volatility smiles of interest rates. At least in these situations, the Vanna-Volga can be expected to interpolate/extrapolate better than SABR.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)