Authors

Summary

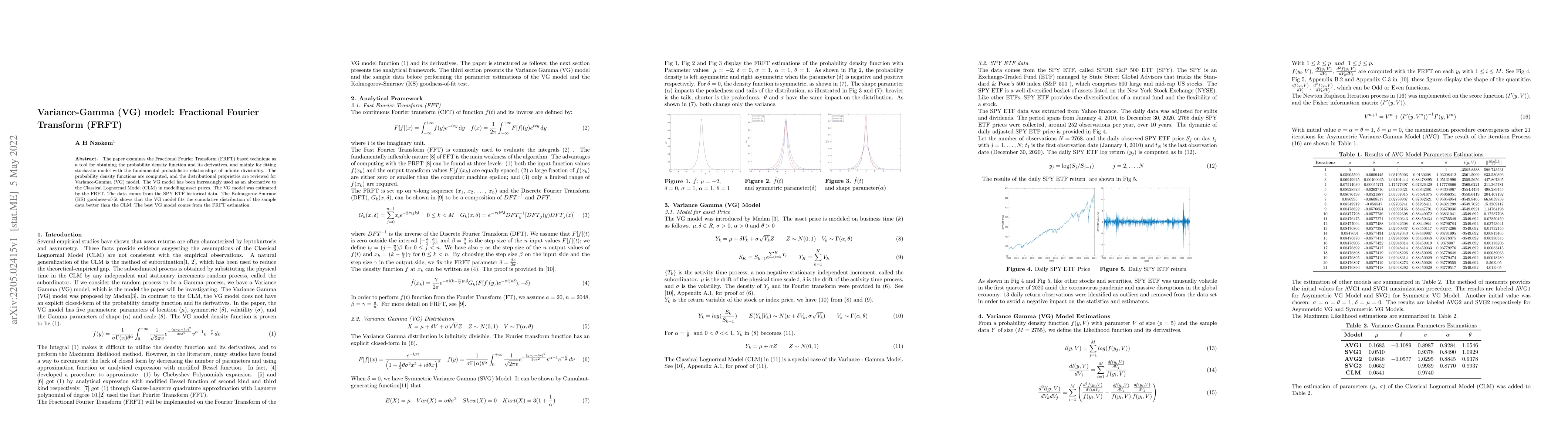

The paper examines the Fractional Fourier Transform (FRFT) based technique as a tool for obtaining the probability density function and its derivatives, and mainly for fitting stochastic model with the fundamental probabilistic relationships of infinite divisibility. The probability density functions are computed, and the distributional proprieties are reviewed for Variance-Gamma (VG) model. The VG model has been increasingly used as an alternative to the Classical Lognormal Model (CLM) in modelling asset prices. The VG model was estimated by the FRFT. The data comes from the SPY ETF historical data. The Kolmogorov-Smirnov (KS) goodness-of-fit shows that the VG model fits the cumulative distribution of the sample data better than the CLM. The best VG model comes from the FRFT estimation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)