Summary

We compute the value of a variance swap when the underlying is modeled as a Markov process time changed by a L\'{e}vy subordinator. In this framework, the underlying may exhibit jumps with a state-dependent L\'{e}vy measure, local stochastic volatility and have a local stochastic default intensity. Moreover, the L\'{e}vy subordinator that drives the underlying can be obtained directly by observing European call/put prices. To illustrate our general framework, we provide an explicit formula for the value of a variance swap when the underlying is modeled as (i) a L\'evy subordinated geometric Brownian motion with default and (ii) a L\'evy subordinated Jump-to-default CEV process (see \citet{carr-linetsky-1}). {In the latter example, we extend} the results of \cite{mendoza-carr-linetsky-1}, by allowing for joint valuation of credit and equity derivatives as well as variance swaps.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

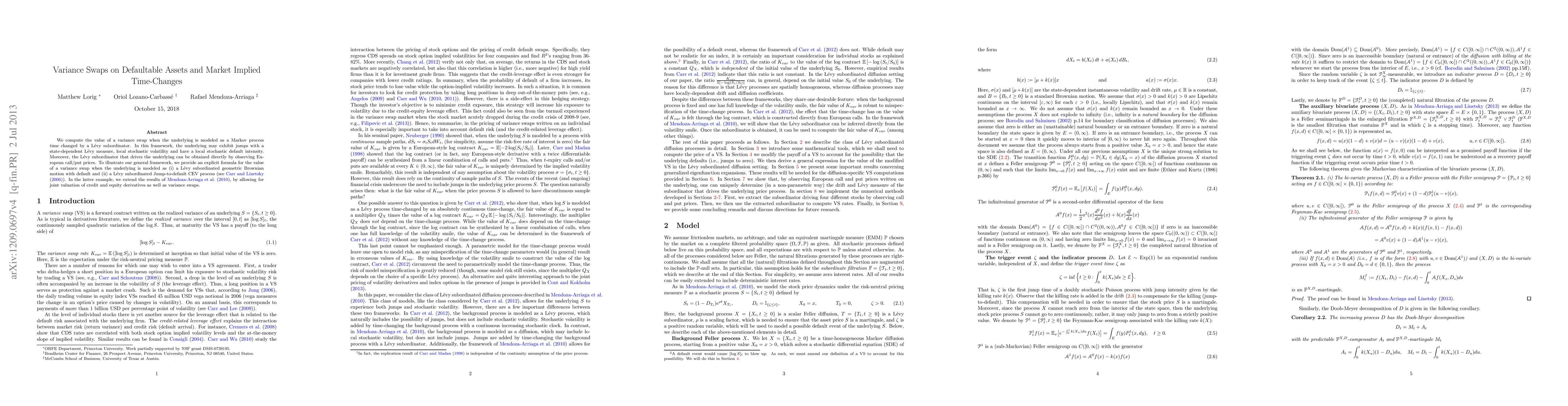

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)