Summary

This paper focuses on the pricing of the variance swap in an incomplete market where the stochastic interest rate and the price of the stock are respectively driven by Cox-Ingersoll-Ross model and Heston model with simultaneous L\'{e}vy jumps. By using the equilibrium framework, we obtain the pricing kernel and the equivalent martingale measure. Moreover, under the forward measure instead of the risk neural measure, we give the closed-form solution for the fair delivery price of the discretely sampled variance swap by employing the joint moment generating function of the underlying processes. Finally, we provide some numerical examples to depict that the values of variance swaps not only depend on the stochastic interest rates but also increase in the presence of jump risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

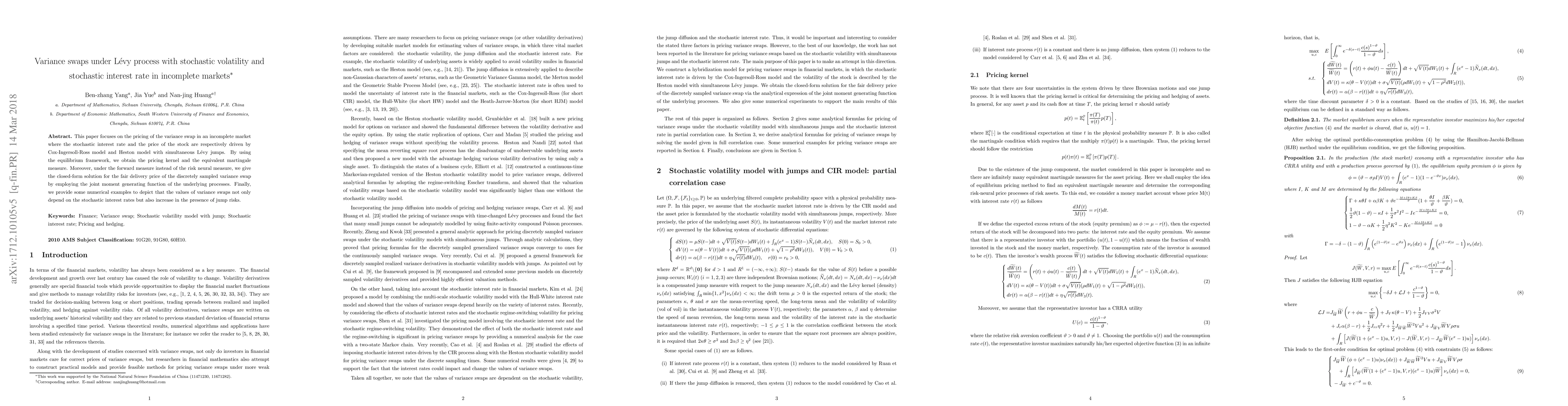

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForeign exchange options on Heston-CIR model under L\'{e}vy process framework

Giacomo Ascione, Giuseppe Orlando, Farshid Mehrdoust et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)