Summary

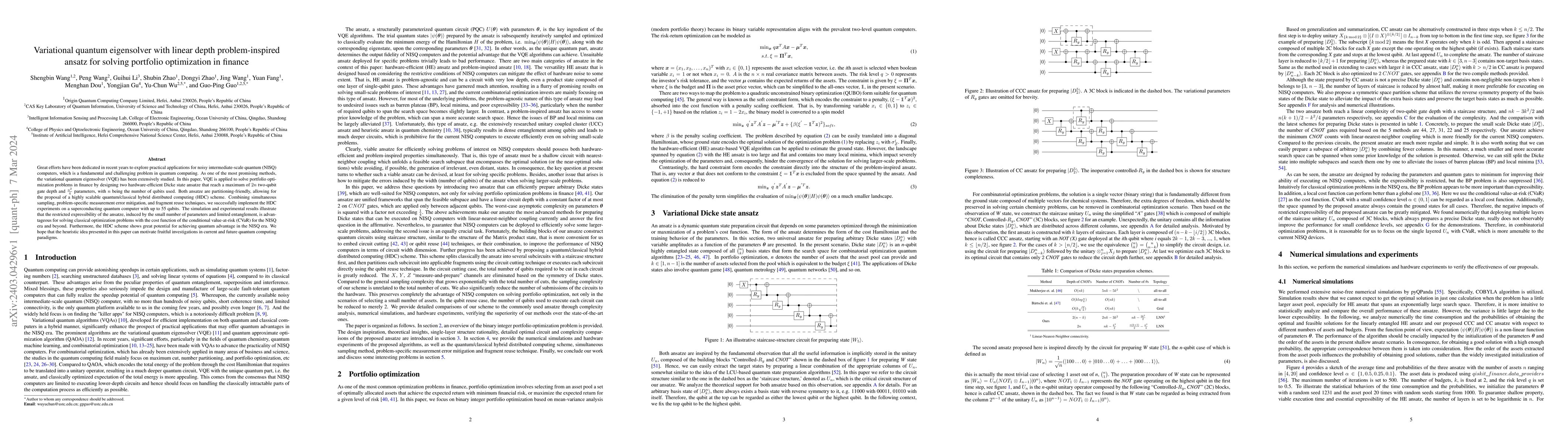

Great efforts have been dedicated in recent years to explore practical applications for noisy intermediate-scale quantum (NISQ) computers, which is a fundamental and challenging problem in quantum computing. As one of the most promising methods, the variational quantum eigensolver (VQE) has been extensively studied. In this paper, VQE is applied to solve portfolio optimization problems in finance by designing two hardware-efficient Dicke state ansatze that reach a maximum of 2n two-qubit gate depth and n^2/4 parameters, with n being the number of qubits used. Both ansatze are partitioning-friendly, allowing for the proposal of a highly scalable quantum/classical hybrid distributed computing (HDC) scheme. Combining simultaneous sampling, problem-specific measurement error mitigation, and fragment reuse techniques, we successfully implement the HDC experiments on the superconducting quantum computer Wu Kong with up to 55 qubits. The simulation and experimental results illustrate that the restricted expressibility of the ansatze, induced by the small number of parameters and limited entanglement, is advantageous for solving classical optimization problems with the cost function of the conditional value-at-risk (CVaR) for the NISQ era and beyond. Furthermore, the HDC scheme shows great potential for achieving quantum advantage in the NISQ era. We hope that the heuristic idea presented in this paper can motivate fruitful investigations in current and future quantum computing paradigms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersScaling the Variational Quantum Eigensolver for Dynamic Portfolio Optimization

Senaida Hernández-Santana, Álvaro Nodar, Irene De León et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)