Summary

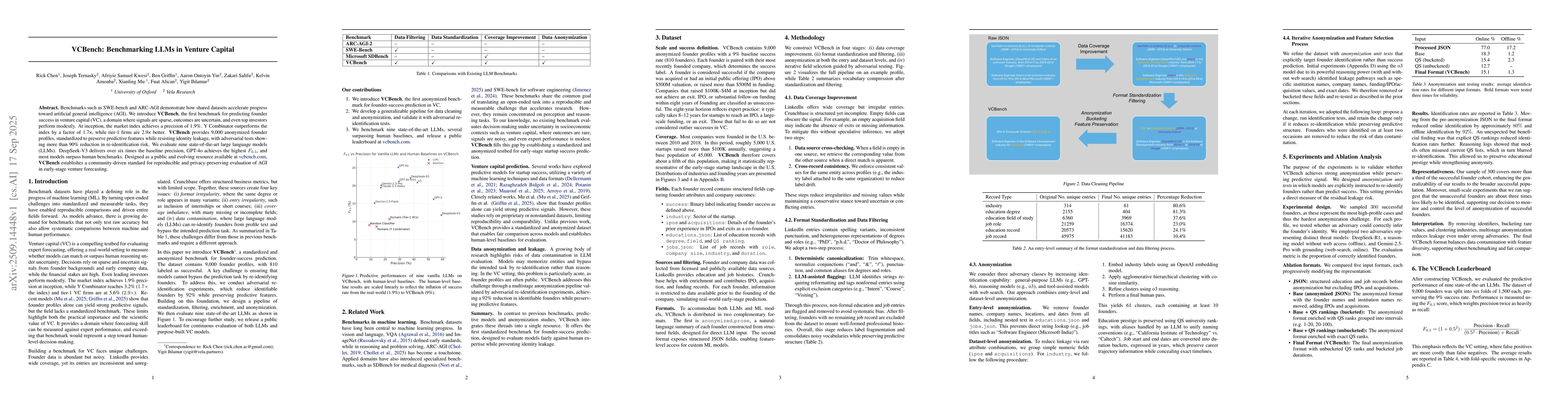

Benchmarks such as SWE-bench and ARC-AGI demonstrate how shared datasets accelerate progress toward artificial general intelligence (AGI). We introduce VCBench, the first benchmark for predicting founder success in venture capital (VC), a domain where signals are sparse, outcomes are uncertain, and even top investors perform modestly. At inception, the market index achieves a precision of 1.9%. Y Combinator outperforms the index by a factor of 1.7x, while tier-1 firms are 2.9x better. VCBench provides 9,000 anonymized founder profiles, standardized to preserve predictive features while resisting identity leakage, with adversarial tests showing more than 90% reduction in re-identification risk. We evaluate nine state-of-the-art large language models (LLMs). DeepSeek-V3 delivers over six times the baseline precision, GPT-4o achieves the highest F0.5, and most models surpass human benchmarks. Designed as a public and evolving resource available at vcbench.com, VCBench establishes a community-driven standard for reproducible and privacy-preserving evaluation of AGI in early-stage venture forecasting.

AI Key Findings

Generated Sep 30, 2025

Methodology

The research introduces VCBench, a standardized and anonymized benchmark for founder-success prediction in venture capital. It employs a multi-stage anonymization pipeline validated by adversarial tests to reduce re-identification risk while preserving predictive signal.

Key Results

- Several state-of-the-art LLMs outperform both the market index and leading VC firms in predicting startup success

- GPT-4o achieves the highest F0.5 score of 25.1 among evaluated models

- The benchmark reduces re-identification risk by over 90% while maintaining predictive signal

Significance

This research establishes a reliable benchmark for evaluating AI-driven venture capital decision-making, enabling reproducible research in a high-stakes domain and offering a path toward more realistic tests of decision-making under uncertainty.

Technical Contribution

The paper's technical contribution is the creation of VCBench, the first standardized and anonymized benchmark for founder-success prediction, along with the multi-stage anonymization pipeline and adversarial validation framework.

Novelty

This work is novel in creating the first anonymized benchmark for venture capital founder success prediction, combining advanced anonymization techniques with adversarial validation to ensure both privacy and predictive utility.

Limitations

- The anonymization process may introduce biases or lose subtle patterns in the data

- The benchmark is based on historical data which may not fully capture future market dynamics

Future Work

- Developing a VC-simulation mode for tournament-style investment decision making

- Creating a gamified arena for human investors, LLMs, and purpose-built VC models to compete

- Exploring richer feature sets and new evaluation modes including simulation and human-AI competitions

Comments (0)