Summary

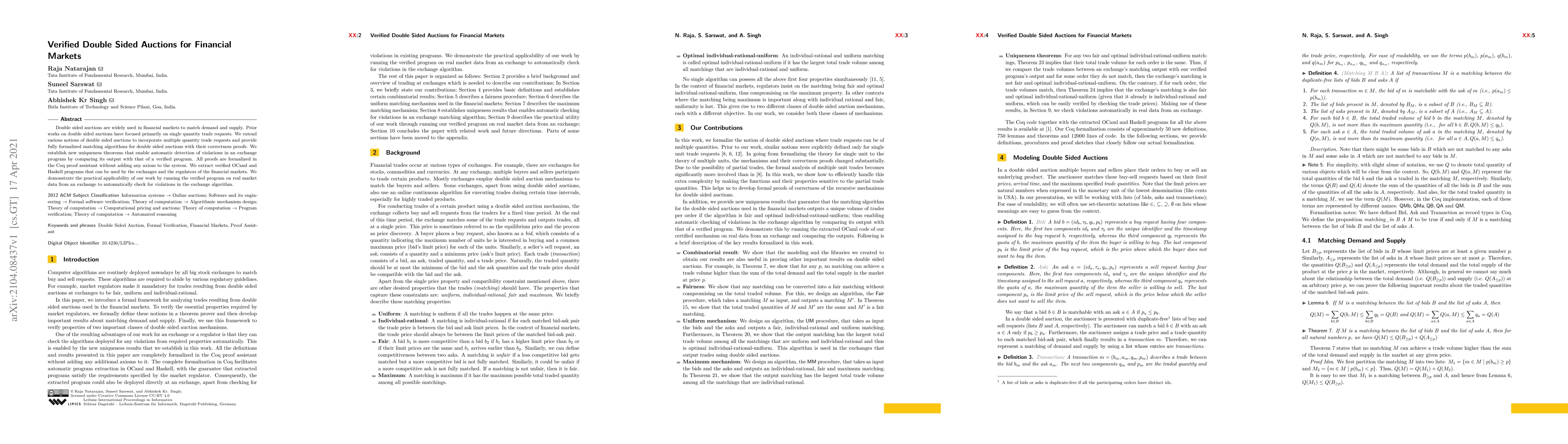

Double sided auctions are widely used in financial markets to match demand and supply. Prior works on double sided auctions have focused primarily on single quantity trade requests. We extend various notions of double sided auctions to incorporate multiple quantity trade requests and provide fully formalized matching algorithms for double sided auctions with their correctness proofs. We establish new uniqueness theorems that enable automatic detection of violations in an exchange program by comparing its output with that of a verified program. All proofs are formalized in the Coq proof assistant without adding any axiom to the system. We extract verified OCaml and Haskell programs that can be used by the exchanges and the regulators of the financial markets. We demonstrate the practical applicability of our work by running the verified program on real market data from an exchange to automatically check for violations in the exchange algorithm.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)