Summary

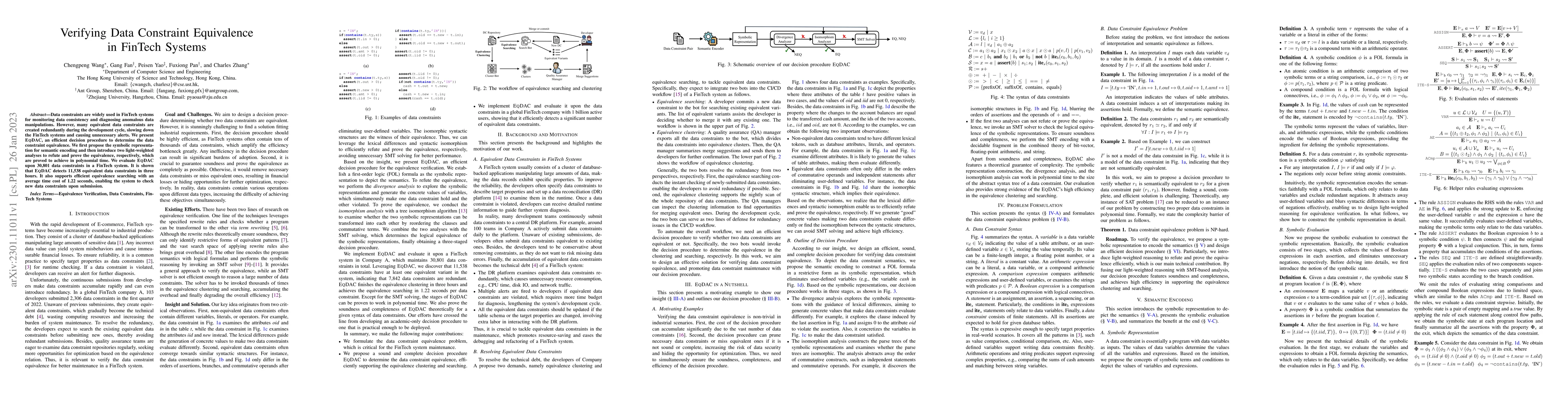

Data constraints are widely used in FinTech systems for monitoring data consistency and diagnosing anomalous data manipulations. However, many equivalent data constraints are created redundantly during the development cycle, slowing down the FinTech systems and causing unnecessary alerts. We present EqDAC, an efficient decision procedure to determine the data constraint equivalence. We first propose the symbolic representation for semantic encoding and then introduce two light-weighted analyses to refute and prove the equivalence, respectively, which are proved to achieve in polynomial time. We evaluate EqDAC upon 30,801 data constraints in a FinTech system. It is shown that EqDAC detects 11,538 equivalent data constraints in three hours. It also supports efficient equivalence searching with an average time cost of 1.22 seconds, enabling the system to check new data constraints upon submission.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)