Authors

Summary

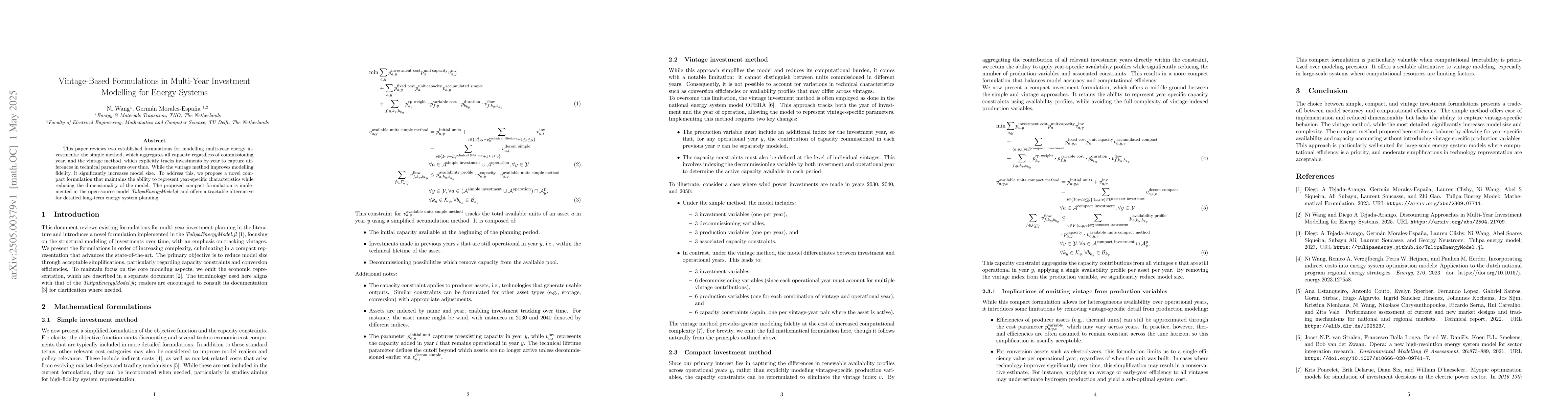

This paper reviews two established formulations for modelling multi-year energy investments: the simple method, which aggregates all capacity regardless of commissioning year, and the vintage method, which explicitly tracks investments by year to capture differences in technical parameters over time. While the vintage method improves modelling fidelity, it significantly increases model size. To address this, we propose a novel compact formulation that maintains the ability to represent year-specific characteristics while reducing the dimensionality of the model. The proposed compact formulation is implemented in the open-source model TulipaEnergyModel.jl and offers a tractable alternative for detailed long-term energy system planning.

AI Key Findings

Generated May 29, 2025

Methodology

The paper reviews two established formulations for multi-year energy investment modeling: the simple method and the vintage method. It proposes a novel compact formulation that maintains the ability to represent year-specific characteristics while reducing model dimensionality.

Key Results

- The vintage method improves modeling fidelity but increases model size significantly.

- A compact formulation is proposed to balance model accuracy and computational efficiency.

- The compact formulation is implemented in the open-source model TulipaEnergyModel.jl.

Significance

This research is important for detailed long-term energy system planning, offering a tractable alternative to existing methods that can handle large-scale systems with limited computational resources.

Technical Contribution

The paper presents a novel compact investment formulation that balances model accuracy and computational efficiency by aggregating capacity contributions from relevant investment years within a single constraint.

Novelty

This work introduces a middle ground between the simple and vintage approaches, allowing for year-specific capacity constraints using availability profiles without the full complexity of vintage-indexed production variables.

Limitations

- The compact formulation omits vintage-specific details from production modeling, which may result in simplifications for certain asset efficiencies.

- For conversion assets, a single efficiency value per operational year is assumed, which may not accurately represent significant technology improvements over time.

Future Work

- Further research could focus on refining the compact formulation to better capture vintage-specific efficiencies for various asset types.

- Exploration of adaptive methods to adjust efficiency parameters over time based on technological advancements.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiscounting Approaches in Multi-Year Investment Modelling for Energy Systems

Ni Wang, Diego A. Tejada-Arango

No citations found for this paper.

Comments (0)