Authors

Summary

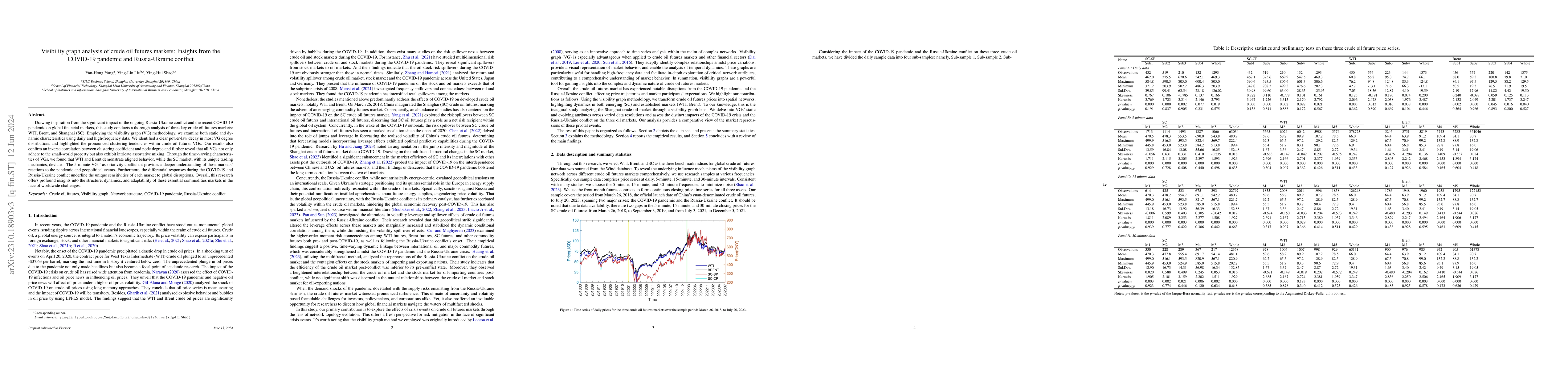

Drawing inspiration from the significant impact of the ongoing Russia-Ukraine conflict and the recent COVID-19 pandemic on global financial markets, this study conducts a thorough analysis of three key crude oil futures markets: WTI, Brent, and Shanghai (SC). Employing the visibility graph (VG) methodology, we examine both static and dynamic characteristics using daily and high-frequency data. We identified a clear power-law decay in most VG degree distributions and highlighted the pronounced clustering tendencies within crude oil futures VGs. Our results also confirm an inverse correlation between clustering coefficient and node degree and further reveal that all VGs not only adhere to the small-world property but also exhibit intricate assortative mixing. Through the time-varying characteristics of VGs, we found that WTI and Brent demonstrate aligned behavior, while the SC market, with its unique trading mechanics, deviates. The 5-minute VGs' assortativity coefficient provides a deeper understanding of these markets' reactions to the pandemic and geopolitical events. Furthermore, the differential responses during the COVID-19 and Russia-Ukraine conflict underline the unique sensitivities of each market to global disruptions. Overall, this research offers profound insights into the structure, dynamics, and adaptability of these essential commodities markets in the face of worldwide challenges.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantile connectedness across BRICS and international grain futures markets: Insights from the Russia-Ukraine conflict

Wei-Xing Zhou, Yan-Hong Yang, Ying-Hui Shao

The short-term effect of COVID-19 pandemic on China's crude oil futures market: A study based on multifractal analysis

Shao Ying-Hui, Liu Ying-Lin, Yang Yan-Hong

The impact of the Russia-Ukraine conflict on the extreme risk spillovers between agricultural futures and spots

Wei-Xing Zhou, Yun-Shi Dai, Kiet Tuan Duong et al.

No citations found for this paper.

Comments (0)