Authors

Summary

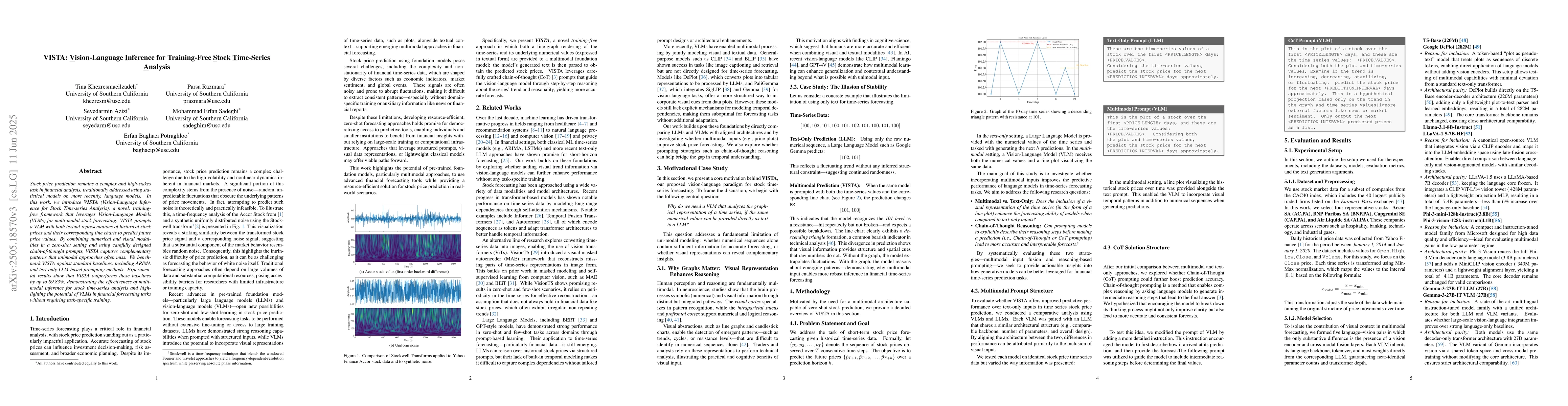

Stock price prediction remains a complex and high-stakes task in financial analysis, traditionally addressed using statistical models or, more recently, language models. In this work, we introduce VISTA (Vision-Language Inference for Stock Time-series Analysis), a novel, training-free framework that leverages Vision-Language Models (VLMs) for multi-modal stock forecasting. VISTA prompts a VLM with both textual representations of historical stock prices and their corresponding line charts to predict future price values. By combining numerical and visual modalities in a zero-shot setting and using carefully designed chain-of-thought prompts, VISTA captures complementary patterns that unimodal approaches often miss. We benchmark VISTA against standard baselines, including ARIMA and text-only LLM-based prompting methods. Experimental results show that VISTA outperforms these baselines by up to 89.83%, demonstrating the effectiveness of multi-modal inference for stock time-series analysis and highlighting the potential of VLMs in financial forecasting tasks without requiring task-specific training.

AI Key Findings

Generated Jun 07, 2025

Methodology

The research introduces VISTA, a training-free framework that uses Vision-Language Models (VLMs) for stock time-series analysis by combining historical stock price textual representations with their corresponding line charts as input prompts.

Key Results

- VISTA outperforms standard baselines, including ARIMA and text-only LLM-based methods, by up to 89.83% in stock price prediction.

- VISTA captures complementary patterns by merging numerical and visual modalities in a zero-shot setting with chain-of-thought prompts.

- The effectiveness of multi-modal inference for stock time-series analysis is demonstrated, highlighting VLMs' potential in financial forecasting without task-specific training.

Significance

This research is significant as it presents a novel, training-free approach for stock price prediction that leverages VLMs, potentially improving financial forecasting accuracy and efficiency.

Technical Contribution

VISTA, a training-free framework utilizing VLMs for multi-modal stock time-series analysis, which combines textual and visual modalities to predict future price values.

Novelty

VISTA distinguishes itself by being the first to apply VLMs in a training-free setting for stock time-series analysis, merging numerical and visual information to outperform unimodal approaches.

Limitations

- The study did not explore the impact of varying VLM sizes or architectures on performance.

- Limited to stock time-series analysis; further investigation needed for applicability to other financial datasets.

Future Work

- Investigate the effect of different VLM models and sizes on stock prediction performance.

- Explore the applicability of VISTA to other financial time-series data beyond stock prices.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersResCLIP: Residual Attention for Training-free Dense Vision-language Inference

Wen Li, Lixin Duan, Yuhang Yang et al.

Pre-training Time Series Models with Stock Data Customization

Mengyu Wang, Shay B. Cohen, Tiejun Ma

VISTA: Unsupervised 2D Temporal Dependency Representations for Time Series Anomaly Detection

Wenming Yang, Fan Zhang, Xiaochen Yang et al.

VISTA: Generative Visual Imagination for Vision-and-Language Navigation

Renjie Li, Zhengzhong Tu, Mingyang Wu et al.

No citations found for this paper.

Comments (0)