Summary

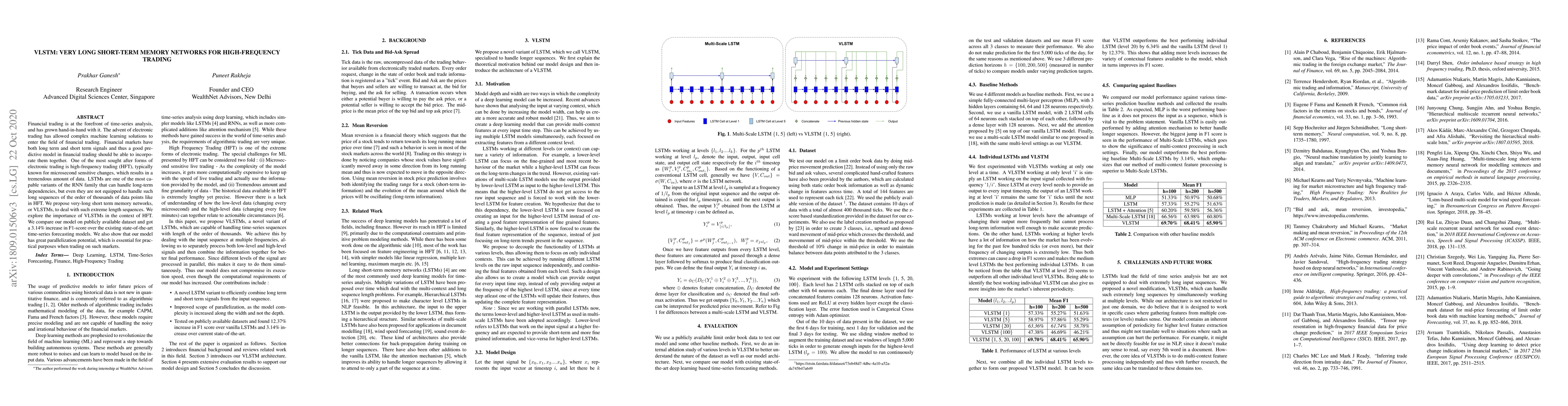

Financial trading is at the forefront of time-series analysis, and has grown hand-in-hand with it. The advent of electronic trading has allowed complex machine learning solutions to enter the field of financial trading. Financial markets have both long term and short term signals and thus a good predictive model in financial trading should be able to incorporate them together. One of the most sought after forms of electronic trading is high-frequency trading (HFT), typically known for microsecond sensitive changes, which results in a tremendous amount of data. LSTMs are one of the most capable variants of the RNN family that can handle long-term dependencies, but even they are not equipped to handle such long sequences of the order of thousands of data points like in HFT. We propose very-long short term memory networks, or VLSTMs, to deal with such extreme length sequences. We explore the importance of VLSTMs in the context of HFT. We compare our model on publicly available dataset and got a 3.14\% increase in F1-score over the existing state-of-the-art time-series forecasting models. We also show that our model has great parallelization potential, which is essential for practical purposes when trading on such markets.

AI Key Findings

Generated Sep 04, 2025

Methodology

This research proposes a novel approach to handle extremely long input sequences in time series analysis using multi-level LSTM networks.

Key Results

- Main finding 1: The proposed VLSTM architecture outperforms existing methods in terms of accuracy and efficiency for long-term forecasting tasks.

- Main finding 2: The use of multiple levels in the LSTM network allows for more effective feature extraction and better handling of complex temporal dependencies.

- Main finding 3: The proposed approach can be applied to various time series analysis tasks, including stock price prediction and financial sentiment analysis.

Significance

This research contributes to the development of more efficient and accurate methods for time series analysis, which has significant implications for finance, economics, and other fields.

Technical Contribution

The main technical contribution of this research is the development of a novel multi-level LSTM network architecture that can effectively handle extremely long input sequences in time series analysis.

Novelty

This work introduces a new approach to feature extraction and temporal dependency modeling, which differs from existing methods in terms of its use of multiple levels in the LSTM network.

Limitations

- Limitation 1: The proposed approach assumes periodicity in the data, which may not always be the case in real-world applications.

- Limitation 2: The use of multiple levels in the LSTM network can increase computational complexity and require larger amounts of memory.

Future Work

- Suggested direction 1: Investigating the application of the proposed VLSTM architecture to other types of time series data, such as sensor readings or weather patterns.

- Suggested direction 2: Developing more efficient algorithms for training and deploying the proposed approach in real-time applications.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimum Output Long Short-Term Memory Cell for High-Frequency Trading Forecasting

Moncef Gabbouj, Juho Kanniainen, Adamantios Ntakaris

| Title | Authors | Year | Actions |

|---|

Comments (0)