Authors

Summary

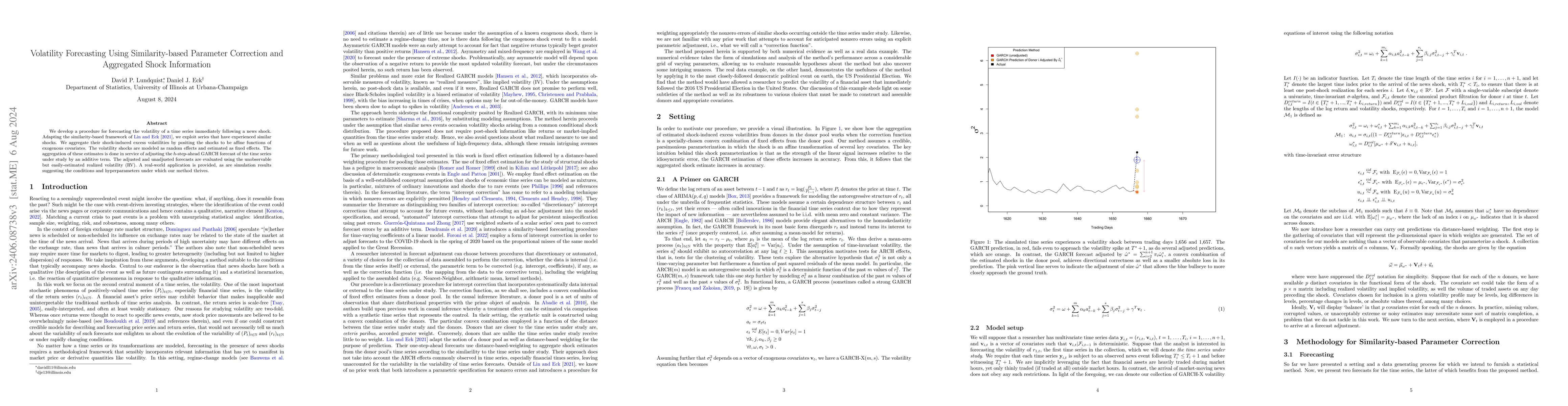

We develop a procedure for forecasting the volatility of a time series immediately following a news shock. Adapting the similarity-based framework of Lin and Eck (2020), we exploit series that have experienced similar shocks. We aggregate their shock-induced excess volatilities by positing the shocks to be affine functions of exogenous covariates. The volatility shocks are modeled as random effects and estimated as fixed effects. The aggregation of these estimates is done in service of adjusting the $h$-step-ahead GARCH forecast of the time series under study by an additive term. The adjusted and unadjusted forecasts are evaluated using the unobservable but easily-estimated realized volatility (RV). A real-world application is provided, as are simulation results suggesting the conditions and hyperparameters under which our method thrives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVolatility forecasting using Deep Learning and sentiment analysis

V Ncume, T. L van Zyl, A Paskaramoorthy

A novel decomposed-ensemble time series forecasting framework: capturing underlying volatility information

Haoyuan Li, Sijie Xu, Yu Chen et al.

Autoencoder Enhanced Realised GARCH on Volatility Forecasting

Chao Wang, Richard Gerlach, Giuseppe Storti et al.

No citations found for this paper.

Comments (0)