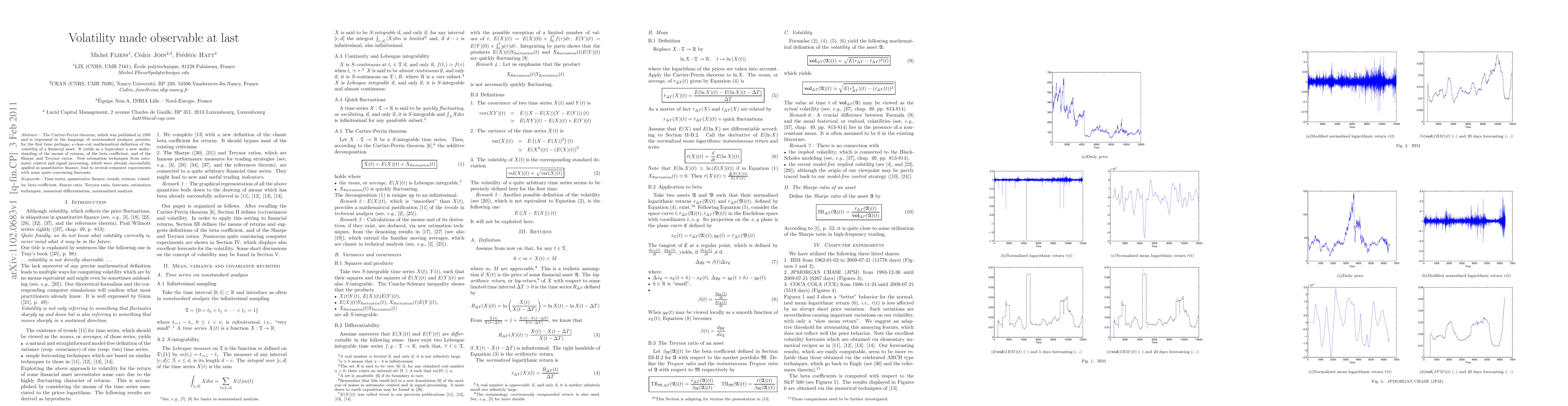

Summary

The Cartier-Perrin theorem, which was published in 1995 and is expressed in the language of nonstandard analysis, permits, for the first time perhaps, a clear-cut mathematical definition of the volatility of a financial asset. It yields as a byproduct a new understanding of the means of returns, of the beta coefficient, and of the Sharpe and Treynor ratios. New estimation techniques from automatic control and signal processing, which were already successfully applied in quantitative finance, lead to several computer experiments with some quite convincing forecasts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)