Summary

The volume weighted average price (VWAP) execution strategy is well known and widely used in practice. In this study, we explicitly introduce a trading volume process into the Almgren-Chriss model, which is a standard model for optimal execution. We then show that the VWAP strategy is the optimal execution strategy for a risk-neutral trader. Moreover, we examine the case of a risk-averse trader and derive the first-order asymptotic expansion of the optimal strategy for a mean-variance optimization problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

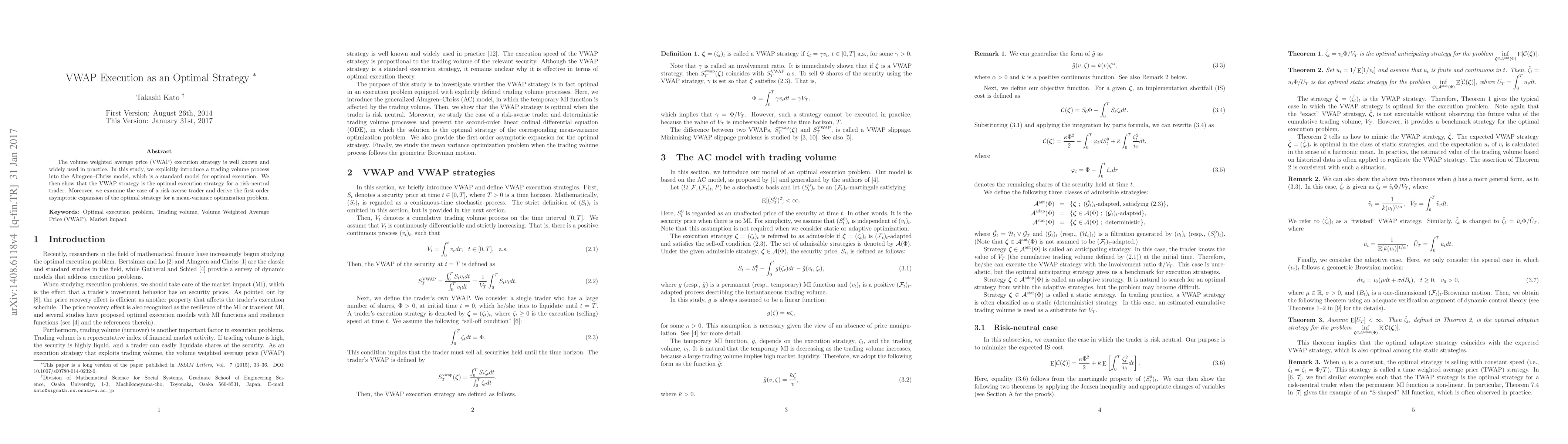

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHierarchical Deep Reinforcement Learning for VWAP Strategy Optimization

Qing Li, Xiaodong Li, Chenxin Zou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)