Summary

We study an agent's lifecycle portfolio choice problem with stochastic labor income, borrowing constraints and a finite retirement date. Similarly to arXiv:2002.00201, wages evolve in a path-dependent way, but the presence of a finite retirement time leads to a novel, two-stage infinite dimensional stochastic optimal control problem with explicit optimal controls in feedback form. This is possible as we find an explicit solution to the associated Hamilton-Jacobi-Bellman (HJB) equation, which is an infinite dimensional PDE of parabolic type. The identification of the optimal feedbacks is delicate due to the presence of time-dependent state constraints, which appear to be new in the infinite dimensional stochastic control literature. The explicit solution allows us to study the properties of optimal strategies and discuss their implications for portfolio choice. As opposed to models with Markovian dynamics, path dependency can now modulate the hedging demand arising from the implicit holding of risky assets in human capital, leading to richer asset allocation predictions consistent with wage rigidity and the agents learning about their earning potential.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

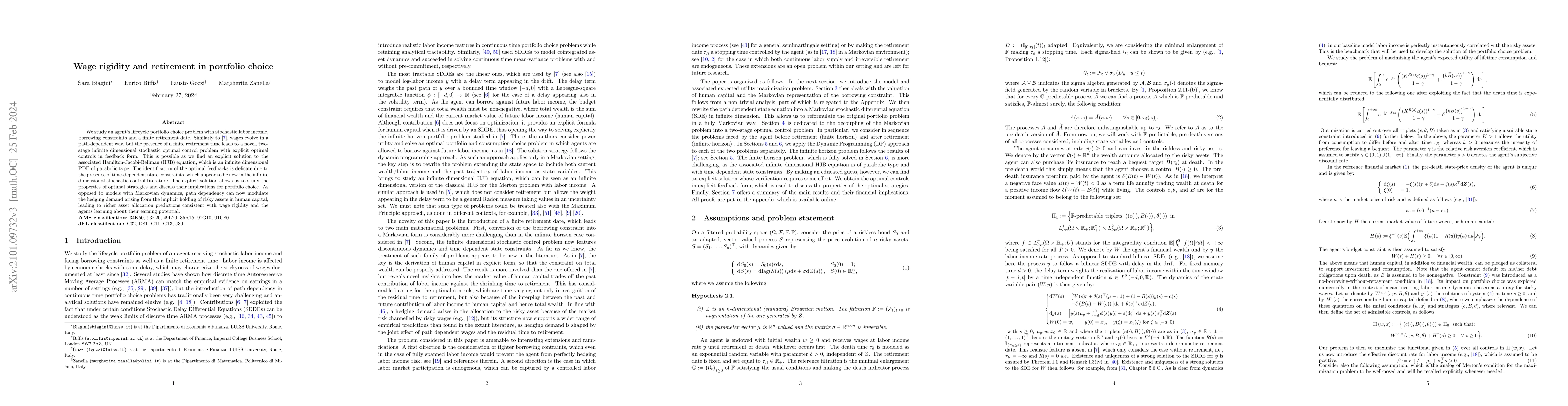

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImpact Of Income And Leisure On Optimal Portfolio, Consumption, Retirement Decisions Under Exponential Utility

Tae Ung Gang, Yong Hyun Shin

A Portfolio Choice Problem Under Risk Capacity Constraint

Zimu Zhu, Weidong Tian

No citations found for this paper.

Comments (0)