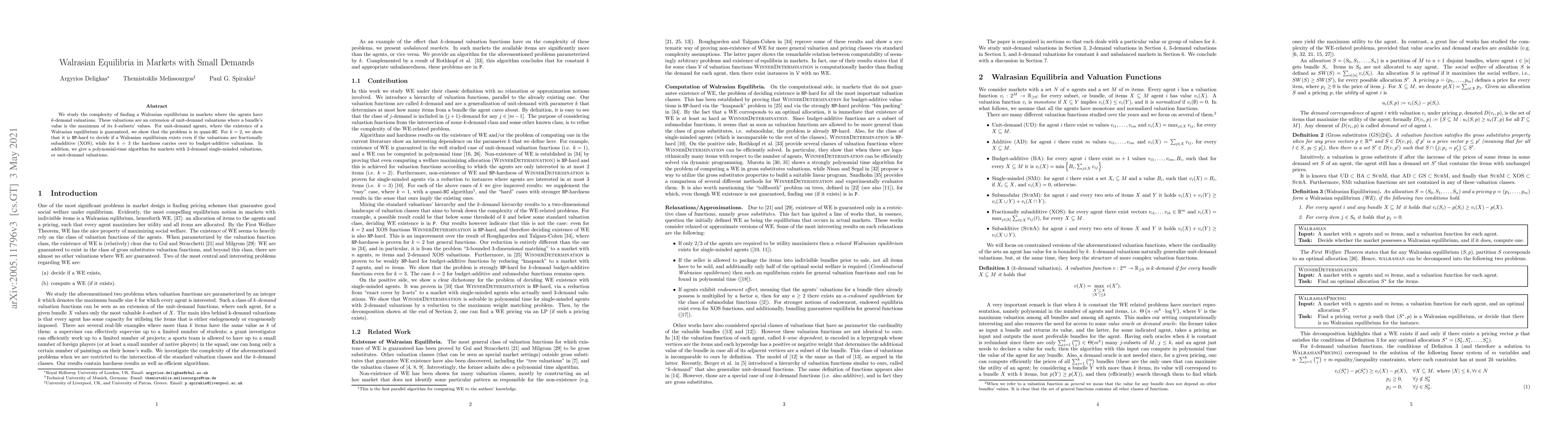

Summary

We study the complexity of finding a Walrasian equilibrium in markets where the agents have $k$-demand valuations. These valuations are an extension of unit-demand valuations where a bundle's value is the maximum of its $k$-subsets' values. For unit-demand agents, where the existence of a Walrasian equilibrium is guaranteed, we show that the problem is in quasi-NC. For $k=2$, we show that it is NP-hard to decide if a Walrasian equilibrium exists even if the valuations are fractionally subadditive (XOS), while for $k=3$ the hardness carries over to budget-additive valuations. In addition, we give a polynomial-time algorithm for markets with 2-demand single-minded valuations, or unit-demand valuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

No similar papers found for this research.

| Title | Authors | Year | Actions |

|---|

Comments (0)