Authors

Summary

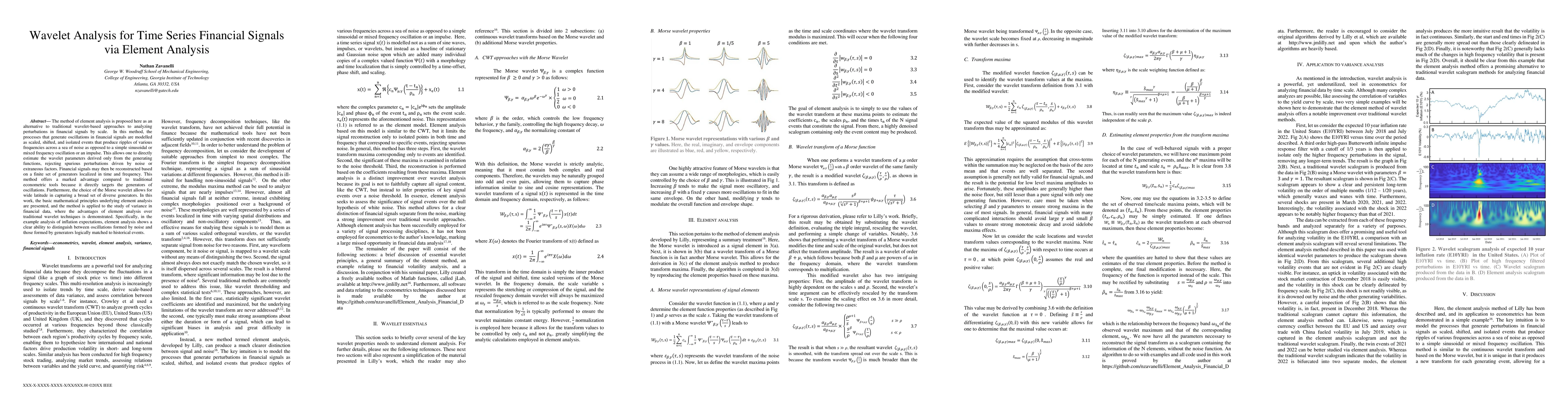

The method of element analysis is proposed here as an alternative to traditional wavelet-based approaches to analyzing perturbations in financial signals by scale. In this method, the processes that generate oscillations in financial signals are modelled as scaled, shifted, and isolated events that produce ripples of various frequencies across a sea of noise as opposed to a simple sinusoidal or mixed frequency oscillation or an impulse. This allows one to directly estimate the wavelet parameters derived only from the generating functions, rejecting spurious perturbations driven by noise or extraneous factors. Financial signals may then be reconstructed based on a finite set of generators localized in time and frequency. This method offers a marked advantage compared to traditional econometric tools because it directly targets the generators of oscillations. Furthermore, the choice of the Morse wavelet allows for wide latitude in capturing a broad set of diverse generators. In this work, the basic mathematical principles underlying element analysis are presented, and the method is applied to the study of variance in financial data, where the advantages of element analysis over traditional wavelet techniques is demonstrated. Specifically, in the example analysis of inflation expectations, element analysis shows a clear ability to distinguish between oscillations formed by noise and those formed by generators logically matched to historical events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)