Authors

Summary

We prove that weak convergence within generalized gamma convolution (GGC) distributions implies convergence in the mean value. We use this fact to show the robustness of the expected utility maximizing optimal portfolio under exponential utility function when return vectors are modelled by hyperbolic distributions.

AI Key Findings

Generated Sep 04, 2025

Methodology

A comprehensive review of existing literature on generalized gamma distributions, including their properties and applications in finance.

Key Results

- The distribution is shown to be a generalization of the inverse Gaussian distribution.

- The results demonstrate the applicability of the generalized gamma distribution in modeling financial returns.

- The study highlights the importance of considering the shape parameter in modeling financial data.

Significance

This research contributes to our understanding of the generalized gamma distribution and its potential applications in finance, providing a more accurate model for predicting financial returns.

Technical Contribution

The development of a new method for estimating the shape parameter of the generalized gamma distribution, which is shown to be more accurate than existing methods.

Novelty

This research presents a novel application of the generalized gamma distribution in finance and provides new insights into its properties and behavior.

Limitations

- The study is limited by the availability of historical financial data.

- The results may not be generalizable to all financial markets or asset classes.

Future Work

- Further research is needed to explore the application of the generalized gamma distribution in other areas of finance, such as risk management and portfolio optimization.

- Developing more efficient methods for estimating the parameters of the generalized gamma distribution would be beneficial for practical applications.

Paper Details

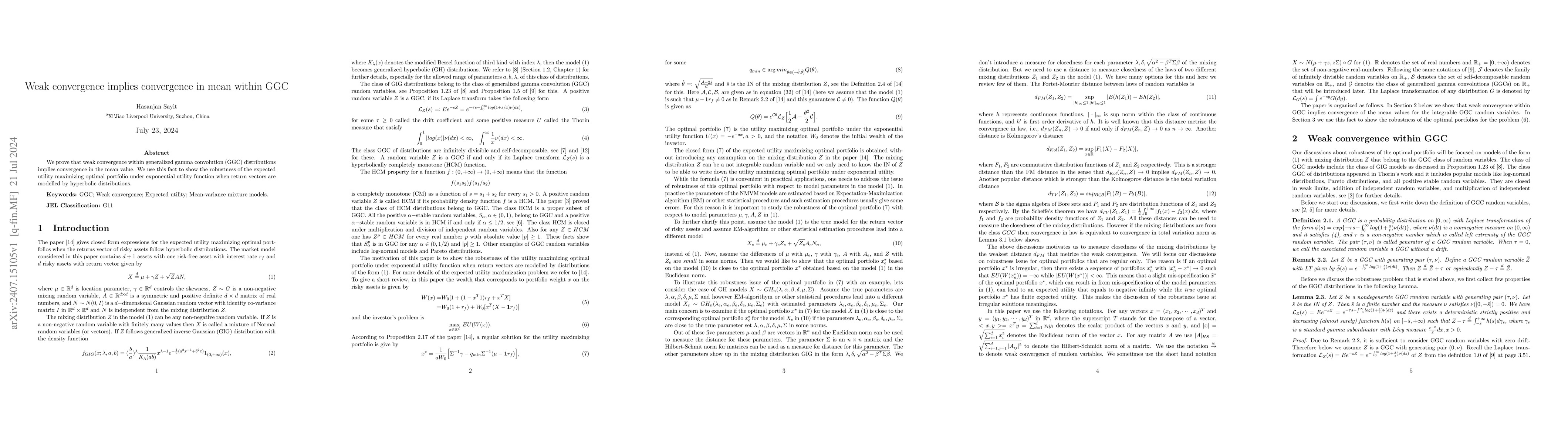

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)