Authors

Summary

In this paper we provide sufficient conditions for sequences of stochastic processes of the form $\int_{[0,t]} f_n(u) \theta_n(u) du$, to weakly converge, in the space of continuous functions over a closed interval, to integrals with respect to the Brownian motion, $\int_{[0,t]} f(u)W(du)$, where $\{f_n\}_n$ is a sequence satisfying some integrability conditions converging to $f$ and $\{\theta_n\}_n$ is a sequence of stochastic processes whose integrals $\int_{[0,t]}\theta_n(u)du$ converge in law to the Brownian motion (in the sense of the finite dimensional distribution convergence), in the multidimensional parameter set case.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper provides sufficient conditions for sequences of stochastic processes to weakly converge in the space of continuous functions over a closed interval to integrals with respect to the Brownian motion.

Key Results

- Sufficient conditions for weak convergence of stochastic integrals are established.

- The convergence is proven for sequences $\int_{[0,t

Significance

This research contributes to the theory of stochastic integration and weak convergence, which are fundamental in stochastic processes and their applications in finance, physics, and engineering.

Technical Contribution

The paper establishes conditions under which sequences of stochastic integrals converge weakly to integrals with respect to Brownian motion, extending previous work to multidimensional parameter sets.

Novelty

The novelty lies in extending the weak convergence results to sequences involving more general stochastic processes and multidimensional parameter sets, providing a more comprehensive framework for stochastic integration theory.

Limitations

- The paper focuses on specific conditions and does not explore the broader applicability of the results.

- The proof techniques might not be easily generalizable to other types of stochastic processes.

Future Work

- Investigate if the conditions can be relaxed to cover a wider class of stochastic processes.

- Explore potential applications in more complex models in finance and physics.

Paper Details

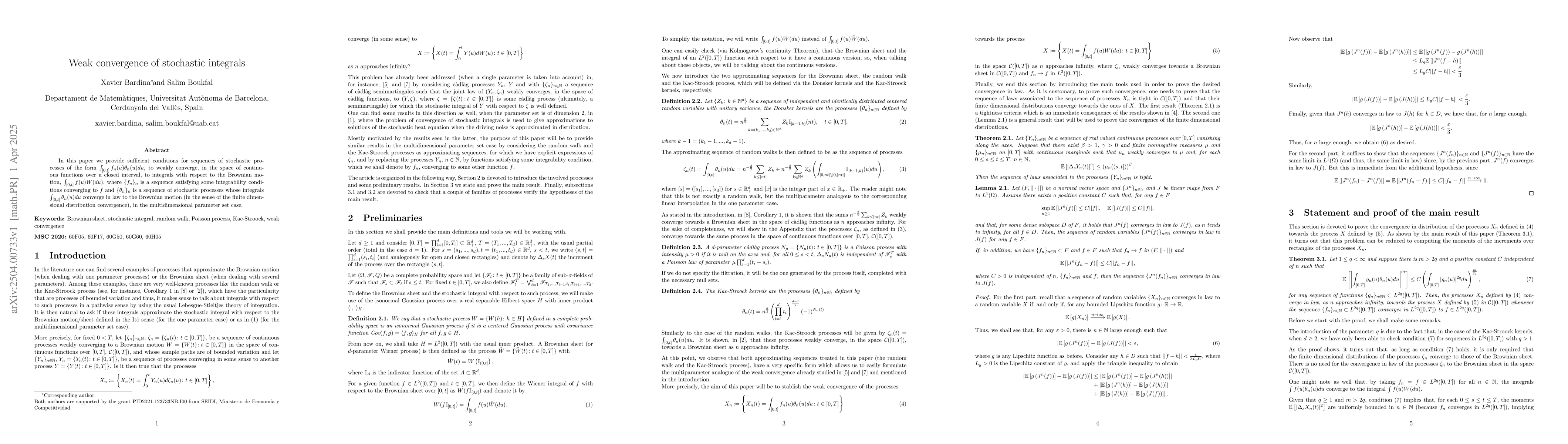

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)