Summary

Factor Sequences are stochastic double sequences indexed in time and cross-section which have a so called factor structure. The term was coined by Forni and Lippi (2001) who introduced dynamic factor sequences. We introduce the distinction between dynamic- and static factor sequences which has been overlooked in the literature. Static factor sequences, where the static factors are modeled by a dynamic system, are the most common model of macro-econometric factor analysis, building on Chamberlain and Rothschild (1983a); Stock and Watson (2002a); Bai and Ng (2002). We show that there exist two types of common components - a dynamic and a static common component. The difference between those consists of the weak common component, which is spanned by (potentially infinitely many) weak factors. We also show that the dynamic common component of a dynamic factor sequence is causally subordinated to the output under suitable conditions. As a consequence only the dynamic common component can be interpreted as the projection on the infinite past of the common innovations of the economy, i.e. the part which is dynamically common. On the other hand the static common component captures only the contemporaneous co-movement.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

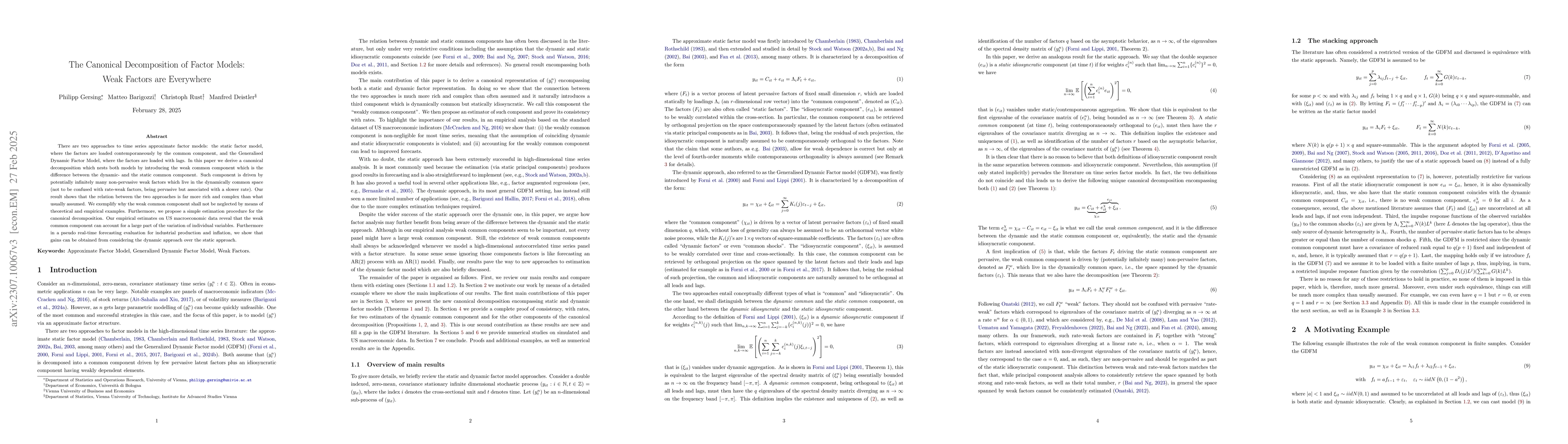

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDifferentiability almost everywhere of weak limits of bi-Sobolev homeomorphisms

Anna Doležalová, Anastasia Molchanova

| Title | Authors | Year | Actions |

|---|

Comments (0)