Summary

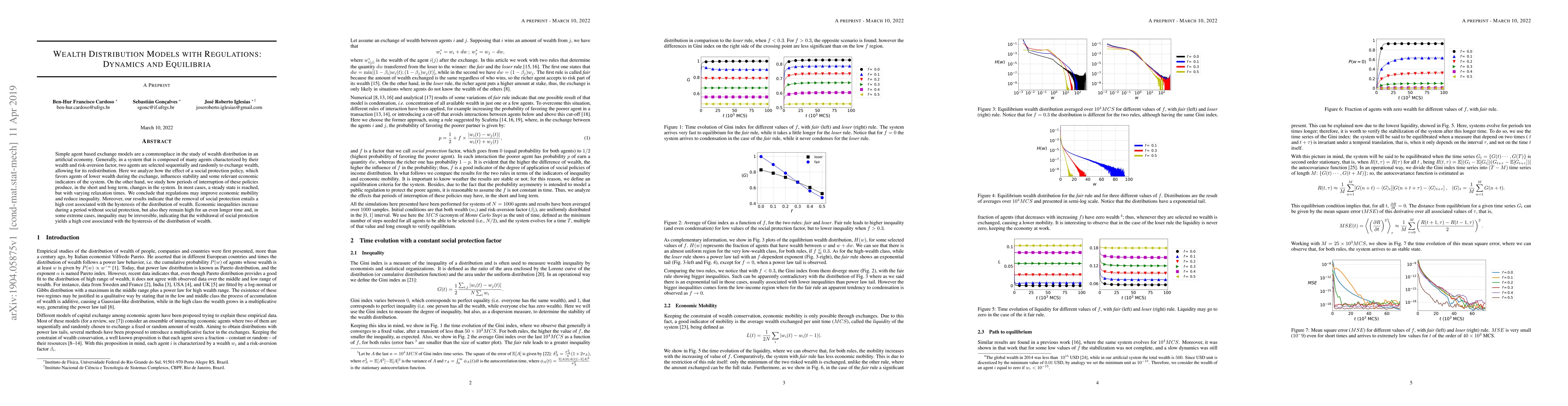

Simple agent based exchange models are a commonplace in the study of wealth distribution in an artificial economy. Generally, in a system that is composed of many agents characterized by their wealth and risk-aversion factor, two agents are selected sequentially and randomly to exchange wealth, allowing for its redistribution. Here we analyze how the effect of a social protection policy, which favors agents of lower wealth during the exchange, influences stability and some relevant economic indicators of the system. On the other hand, we study how periods of interruption of these policies produce, in the short and long term, changes in the system. In most cases, a steady state is reached, but with varying relaxation times. We conclude that regulations may improve economic mobility and reduce inequality. Moreover, our results indicate that the removal of social protection entails a high cost associated with the hysteresis of the distribution of wealth. Economic inequalities increase during a period without social protection, but also they remain high for an even longer time and, in some extreme cases, inequality may be irreversible, indicating that the withdrawal of social protection yields a high cost associated with the hysteresis of the distribution of wealth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)