Summary

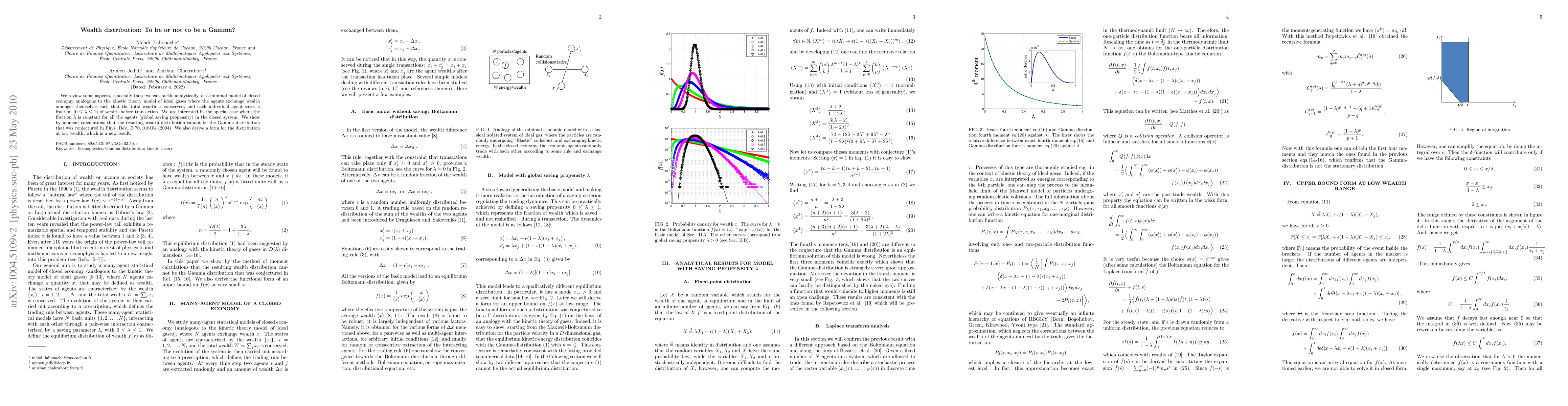

We review some aspects, especially those we can tackle analytically, of a minimal model of closed economy analogous to the kinetic theory model of ideal gases where the agents exchange wealth amongst themselves such that the total wealth is conserved, and each individual agent saves a fraction (0 < lambda < 1) of wealth before transaction. We are interested in the special case where the fraction lambda is constant for all the agents (global saving propensity) in the closed system. We show by moment calculations that the resulting wealth distribution cannot be the Gamma distribution that was conjectured in Phys. Rev. E 70, 016104 (2004). We also derive a form for the distribution at low wealth, which is a new result.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research analyzes a minimal model of a closed economy where agents exchange wealth, conserving total wealth, and each agent saves a fraction (0 < lambda < 1) of their wealth before transactions. The focus is on the special case of constant global saving propensity lambda for all agents.

Key Results

- The wealth distribution resulting from this model cannot be the Gamma distribution, contradicting a previous conjecture.

- A new form for the wealth distribution at low wealth is derived.

- The first three moments of the distribution match those of the Gamma distribution, but the fourth moments differ, confirming the Gamma distribution is not the equilibrium solution.

Significance

This study challenges the previous conjecture that wealth distribution follows a Gamma distribution, providing a more accurate description of wealth dynamics in closed economies.

Technical Contribution

The paper presents analytical results showing that the wealth distribution in the model with global saving propensity lambda does not follow a Gamma distribution, providing a new form for the distribution at low wealth.

Novelty

The research disproves the previous conjecture that wealth distribution follows a Gamma distribution, offering a novel analytical form for the wealth distribution at low wealth ranges in a closed economy model.

Limitations

- The research is limited to a minimal model of a closed economy and does not account for external factors or real-world complexities.

- The analysis assumes constant global saving propensity, which may not reflect real-world scenarios where saving propensities can vary among agents.

Future Work

- Investigate wealth distribution in more complex economic models with varying saving propensities among agents.

- Explore the impact of external factors, such as government policies or global economic trends, on wealth distribution.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTo Half--Be or Not To Be?

Lavinia Heisenberg, Sebastian Garcia-Saenz, Claudia de Rham et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)