Summary

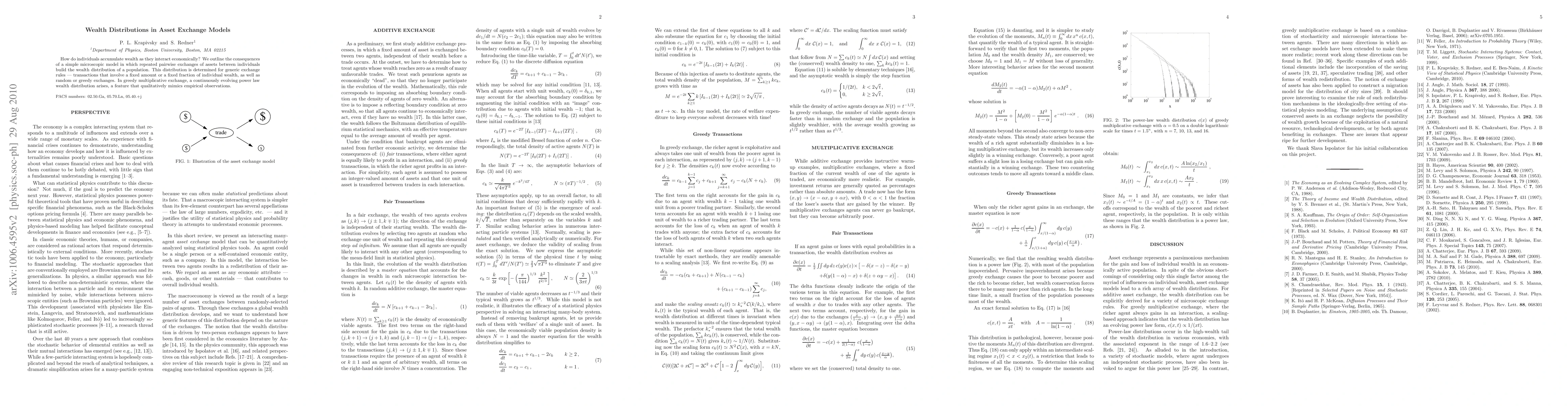

How do individuals accumulate wealth as they interact economically? We outline the consequences of a simple microscopic model in which repeated pairwise exchanges of assets between individuals build the wealth distribution of a population. This distribution is determined for generic exchange rules --- transactions that involve a fixed amount or a fixed fraction of individual wealth, as well as random or greedy exchanges. In greedy multiplicative exchange, a continuously evolving power law wealth distribution arises, a feature that qualitatively mimics empirical observations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic Maps, Wealth Distribution in Random Asset Exchange Models and the Marginal Utility of Relative Wealth

Sitabhra Sinha

Wealth Distributions in Models of Capital Exchange

P. L. Krapivsky, S. Redner, S. Ispolatov

| Title | Authors | Year | Actions |

|---|

Comments (0)