Authors

Summary

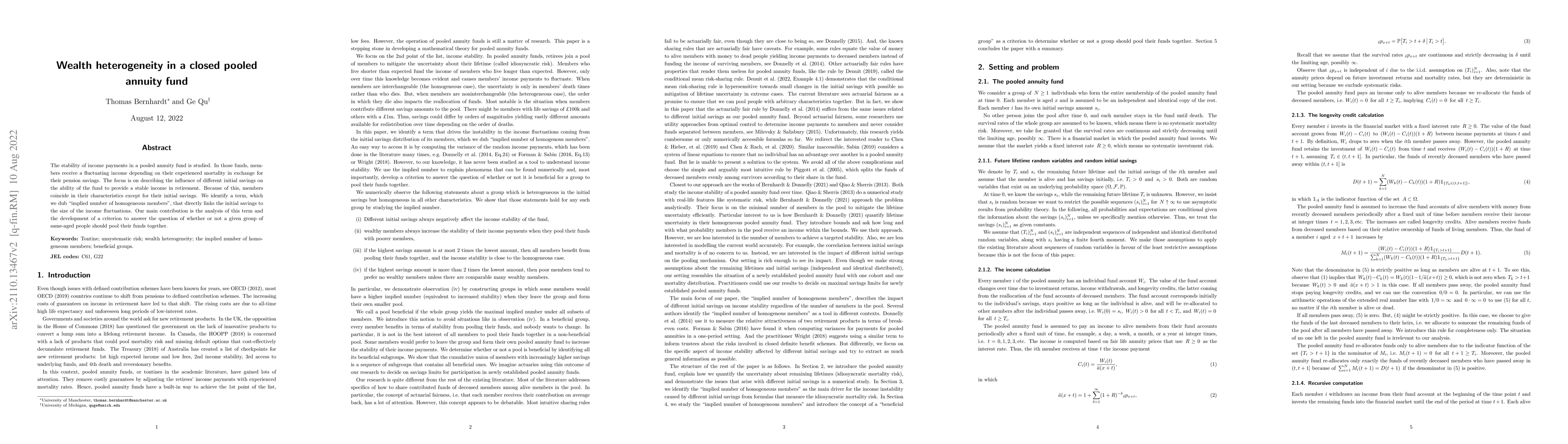

The stability of income payments in a pooled annuity fund is studied. In those funds, members receive a fluctuating income depending on their experienced mortality in exchange for their pension savings. The focus is on describing the influence of different initial savings on the ability of the fund to provide a stable income in retirement. Because of this, members coincide in their characteristics except for their initial savings. We identify a term, which we dub ``implied number of homogeneous members'', that directly links the initial savings to the size of the income fluctuations. Our main contribution is the analysis of this term and the development of a criterion to answer the question of whether or not a given group of same-aged people should pool their funds together.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)