Summary

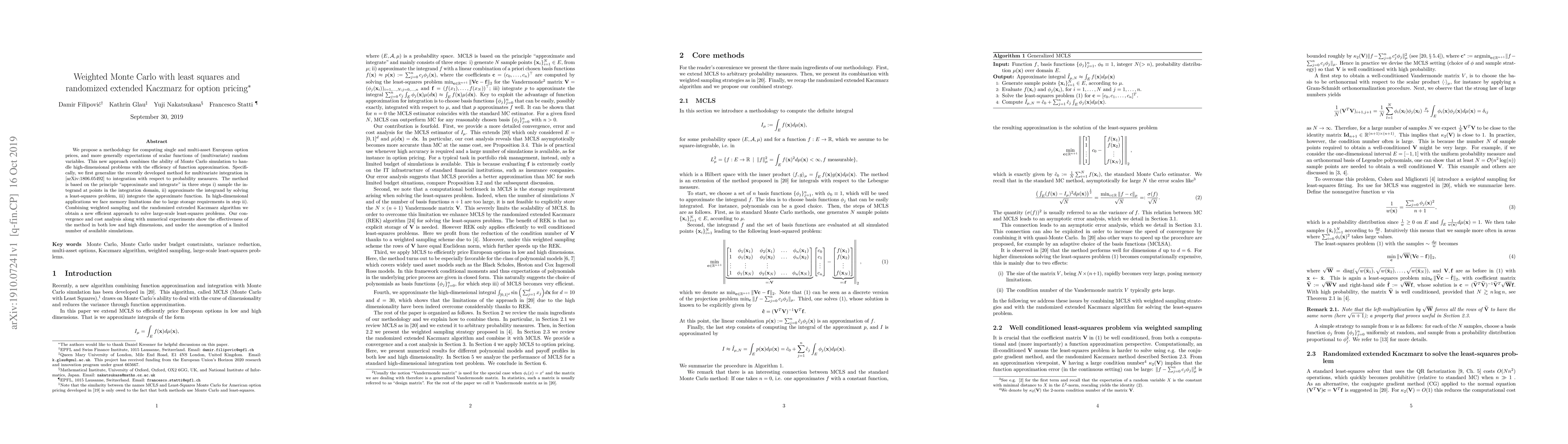

We propose a methodology for computing single and multi-asset European option prices, and more generally expectations of scalar functions of (multivariate) random variables. This new approach combines the ability of Monte Carlo simulation to handle high-dimensional problems with the efficiency of function approximation. Specifically, we first generalize the recently developed method for multivariate integration in [arXiv:1806.05492] to integration with respect to probability measures. The method is based on the principle "approximate and integrate" in three steps i) sample the integrand at points in the integration domain, ii) approximate the integrand by solving a least-squares problem, iii) integrate the approximate function. In high-dimensional applications we face memory limitations due to large storage requirements in step ii). Combining weighted sampling and the randomized extended Kaczmarz algorithm we obtain a new efficient approach to solve large-scale least-squares problems. Our convergence and cost analysis along with numerical experiments show the effectiveness of the method in both low and high dimensions, and under the assumption of a limited number of available simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtended Randomized Kaczmarz Method for Sparse Least Squares and Impulsive Noise Problems

Maximilian Winkler, Lionel Tondji, Dirk A Lorenz et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)