Summary

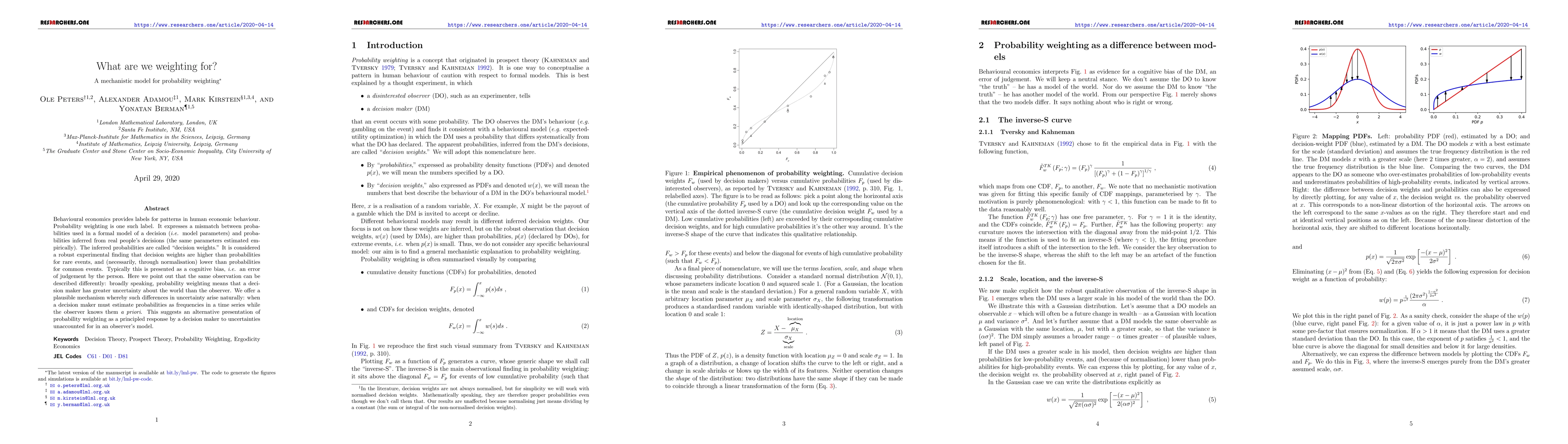

Behavioural economics provides labels for patterns in human economic behaviour. Probability weighting is one such label. It expresses a mismatch between probabilities used in a formal model of a decision (i.e. model parameters) and probabilities inferred from real people's decisions (the same parameters estimated empirically). The inferred probabilities are called "decision weights." It is considered a robust experimental finding that decision weights are higher than probabilities for rare events, and (necessarily, through normalisation) lower than probabilities for common events. Typically this is presented as a cognitive bias, i.e. an error of judgement by the person. Here we point out that the same observation can be described differently: broadly speaking, probability weighting means that a decision maker has greater uncertainty about the world than the observer. We offer a plausible mechanism whereby such differences in uncertainty arise naturally: when a decision maker must estimate probabilities as frequencies in a time series while the observer knows them a priori. This suggests an alternative presentation of probability weighting as a principled response by a decision maker to uncertainties unaccounted for in an observer's model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOverlap, matching, or entropy weights: what are we weighting for?

Yi Liu, Yunji Zhou, Roland A. Matsouaka

| Title | Authors | Year | Actions |

|---|

Comments (0)