Summary

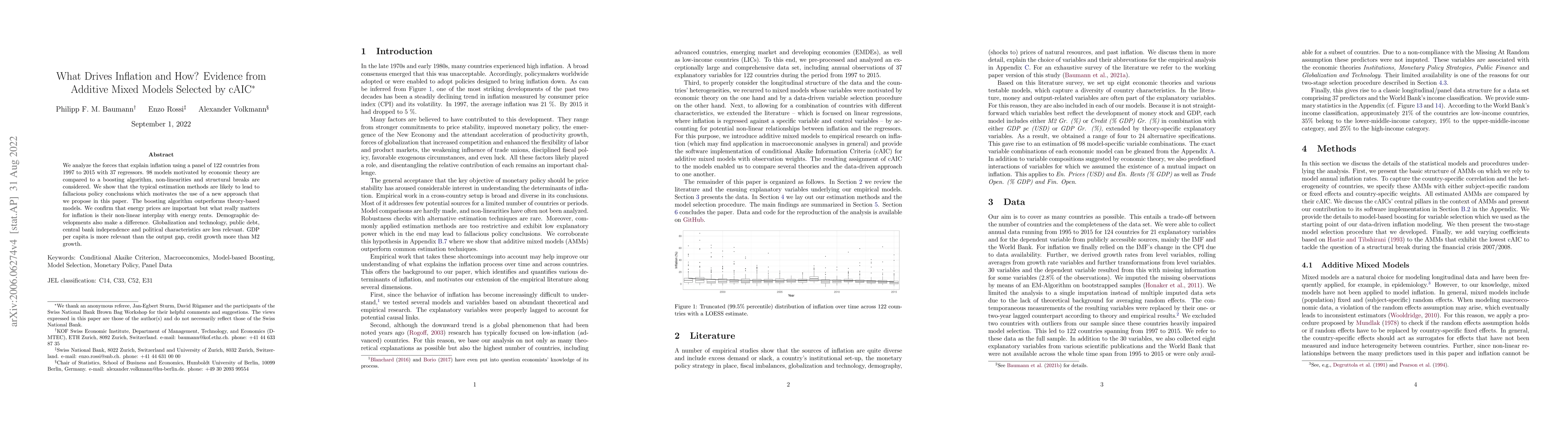

We analyze the forces that explain inflation using a panel of 122 countries from 1997 to 2015 with 37 regressors. 98 models motivated by economic theory are compared to a gradient boosting algorithm, non-linearities and structural breaks are considered. We show that the typical estimation methods are likely to lead to fallacious policy conclusions which motivates the use of a new approach that we propose in this paper. The boosting algorithm outperforms theory-based models. We confirm that energy prices are important but what really matters for inflation is their non-linear interplay with energy rents. Demographic developments also make a difference. Globalization and technology, public debt, central bank independence and political characteristics are less relevant. GDP per capita is more relevant than the output gap, credit growth more than M2 growth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)