Summary

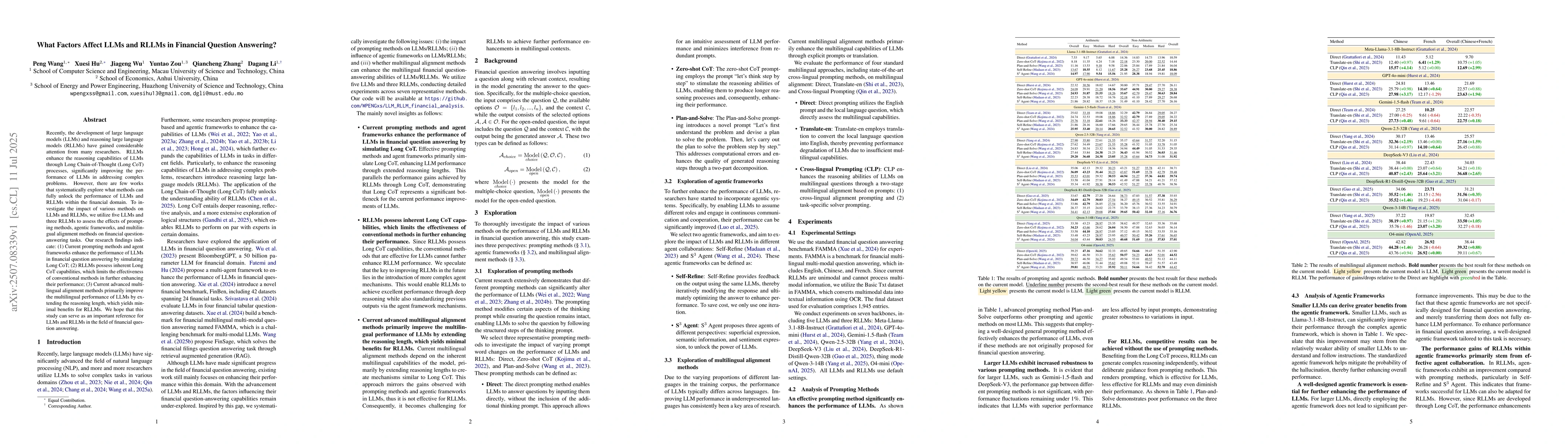

Recently, the development of large language models (LLMs) and reasoning large language models (RLLMs) have gained considerable attention from many researchers. RLLMs enhance the reasoning capabilities of LLMs through Long Chain-of-Thought (Long CoT) processes, significantly improving the performance of LLMs in addressing complex problems. However, there are few works that systematically explore what methods can fully unlock the performance of LLMs and RLLMs within the financial domain. To investigate the impact of various methods on LLMs and RLLMs, we utilize five LLMs and three RLLMs to assess the effects of prompting methods, agentic frameworks, and multilingual alignment methods on financial question-answering tasks. Our research findings indicate: (1) Current prompting methods and agent frameworks enhance the performance of LLMs in financial question answering by simulating Long CoT; (2) RLLMs possess inherent Long CoT capabilities, which limits the effectiveness of conventional methods in further enhancing their performance; (3) Current advanced multilingual alignment methods primarily improve the multilingual performance of LLMs by extending the reasoning length, which yields minimal benefits for RLLMs. We hope that this study can serve as an important reference for LLMs and RLLMs in the field of financial question answering.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvaluating LLMs' Mathematical Reasoning in Financial Document Question Answering

Vivek Gupta, Dan Roth, Tanuja Ganu et al.

Multi-Document Financial Question Answering using LLMs

Shalin Shah, Srikanth Ryali, Ramasubbu Venkatesh

FinanceBench: A New Benchmark for Financial Question Answering

Anand Kannappan, Douwe Kiela, Rebecca Qian et al.

Improved LLM Agents for Financial Document Question Answering

Liang Zhang, Dong Yang, Nelvin Tan et al.

No citations found for this paper.

Comments (0)