Summary

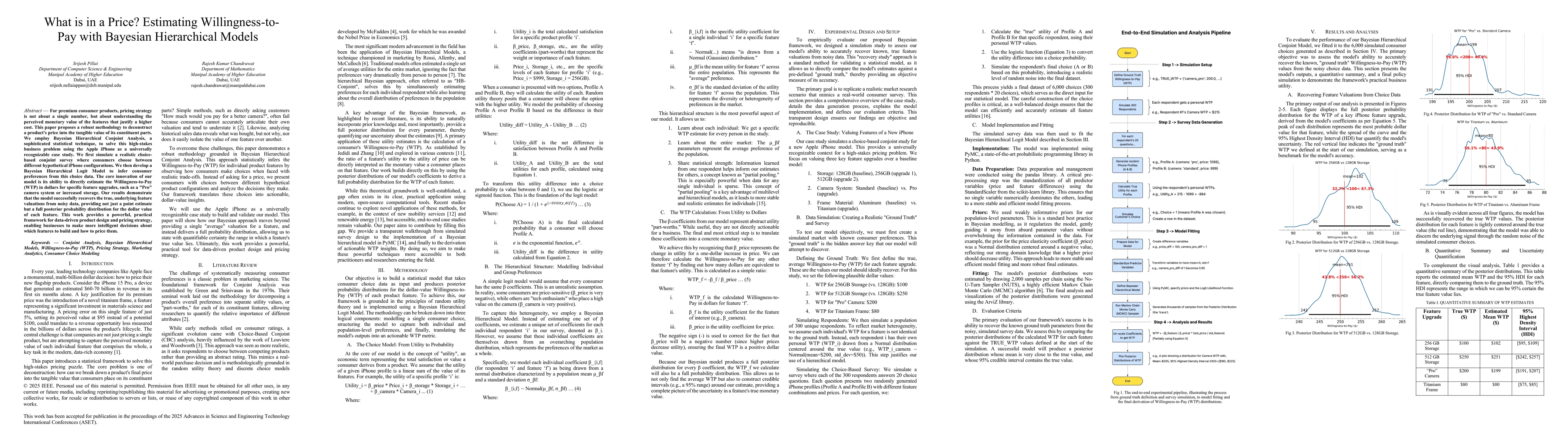

For premium consumer products, pricing strategy is not about a single number, but about understanding the perceived monetary value of the features that justify a higher cost. This paper proposes a robust methodology to deconstruct a product's price into the tangible value of its constituent parts. We employ Bayesian Hierarchical Conjoint Analysis, a sophisticated statistical technique, to solve this high-stakes business problem using the Apple iPhone as a universally recognizable case study. We first simulate a realistic choice based conjoint survey where consumers choose between different hypothetical iPhone configurations. We then develop a Bayesian Hierarchical Logit Model to infer consumer preferences from this choice data. The core innovation of our model is its ability to directly estimate the Willingness-to-Pay (WTP) in dollars for specific feature upgrades, such as a "Pro" camera system or increased storage. Our results demonstrate that the model successfully recovers the true, underlying feature valuations from noisy data, providing not just a point estimate but a full posterior probability distribution for the dollar value of each feature. This work provides a powerful, practical framework for data-driven product design and pricing strategy, enabling businesses to make more intelligent decisions about which features to build and how to price them.

AI Key Findings

Generated Oct 02, 2025

Methodology

The research employs Bayesian Hierarchical Conjoint Analysis to estimate Willingness-to-Pay (WTP) by modeling consumer choices using a hierarchical Bayesian Logit Model. It simulates a choice-based conjoint survey with hypothetical iPhone configurations and uses PyMC for Bayesian inference.

Key Results

- The model successfully recovers true feature valuations from noisy data, providing posterior distributions for WTP estimates.

- Estimated mean WTP values closely match the predefined ground truth values with narrow credible intervals.

- A revenue optimization simulation identified $999 as the optimal price for an iPhone Pro bundle based on WTP distributions.

Significance

This research provides a practical framework for data-driven product design and pricing strategy, enabling businesses to make informed decisions about feature prioritization and pricing based on quantified consumer preferences.

Technical Contribution

The paper introduces a Bayesian Hierarchical Logit Model that simultaneously estimates individual and population-level preferences, enabling precise WTP estimation with uncertainty quantification through posterior distributions.

Novelty

This work novelly applies Bayesian hierarchical models to directly estimate monetary WTP for product features using simulated choice data, offering a transparent, end-to-end framework accessible via open-source tools like PyMC.

Limitations

- The study relies on simulated data rather than real-world consumer behavior, potentially limiting external validity.

- Assumes independent choices across respondents, ignoring potential learning effects or fatigue during surveys.

Future Work

- Validate WTP estimates against real-world sales data to improve predictive accuracy.

- Incorporate feature interactions into the utility model to capture synergistic effects.

- Integrate competitor actions into the choice model to simulate dynamic market conditions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDeterminants of Treatment Willingness and Willingness-to-Pay for Lecanemab in China: A Network Analysis.

Yi, Yang, Qin, Xiaohong, Xiao, Jun et al.

Comments (0)