Authors

Summary

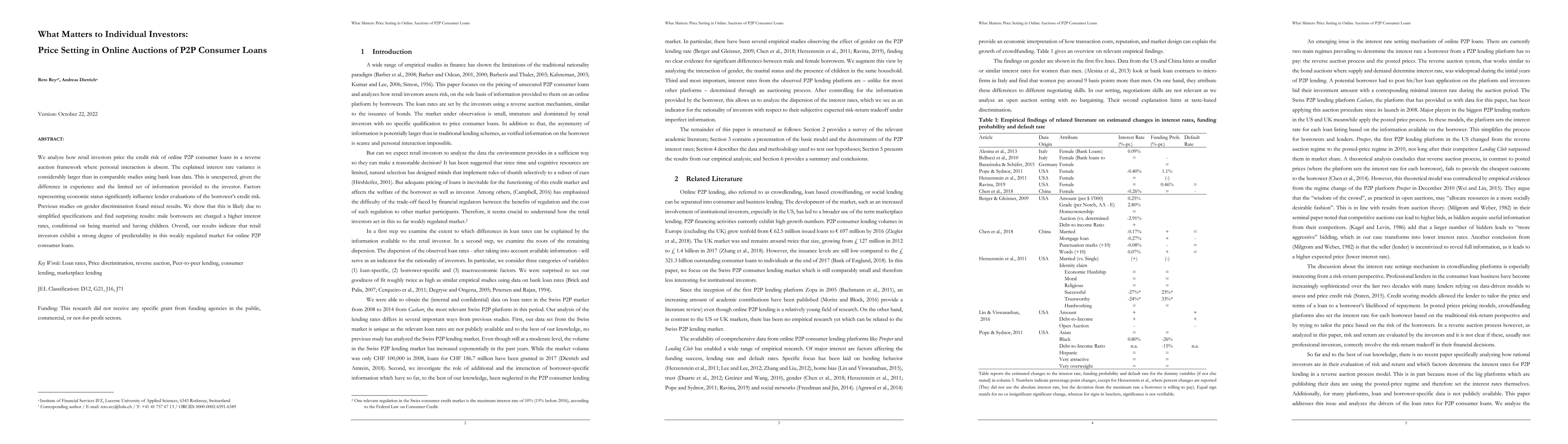

We analyze how retail investors price the credit risk of online P"P consumer loans in a reverse auction framework where personal interaction is absent. The explained interest rate variance is considerably larger than in comparable studies using bank loan data. This is unexpected, given the difference in experience and the limited set of information provided to the investor. Factors representing economic status significantly influence lender evaluations of the borrower's credit risk. Previous studies on gender discrimination found mixed results. We show that this is likely due to simplified specifications and find surprising results: male borrowers are charged a higher interest rates, conditional on being married and having children. Overall, our results indicate that retail investors exhibit a strong degree of predictability in this weakly regulated market for online P2P consumer loans.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo-Regret Online Autobidding Algorithms in First-price Auctions

Yilin Li, Hanrui Zhang, Wei Tang et al.

A non-parametric approach for estimating consumer valuation distributions using second price auctions

Sourav Mukherjee, Kshitij Khare, Rohit K Patra

Learning to Bid in Repeated First-Price Auctions with Budgets

Qian Wang, Xiaotie Deng, Yuqing Kong et al.

A Competitive Posted-Price Mechanism for Online Budget-Feasible Auctions

Dimitris Fotakis, Andreas Charalampopoulos, Panagiotis Patsilinakos et al.

No citations found for this paper.

Comments (0)