Summary

In this paper we investigate a class of swing options with firm constraints in view of the modeling of supply agreements. We show, for a fully general payoff process, that the premium, solution to a stochastic control problem, is concave and piecewise affine as a function of the global constraints of the contract. The existence of bang-bang optimal controls is established for a set of constraints which generates by affinity the whole premium function. When the payoff process is driven by an underlying Markov process, we propose a quantization based recursive backward procedure to price these contracts. A priori error bounds are established, uniformly with respect to the global constraints.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

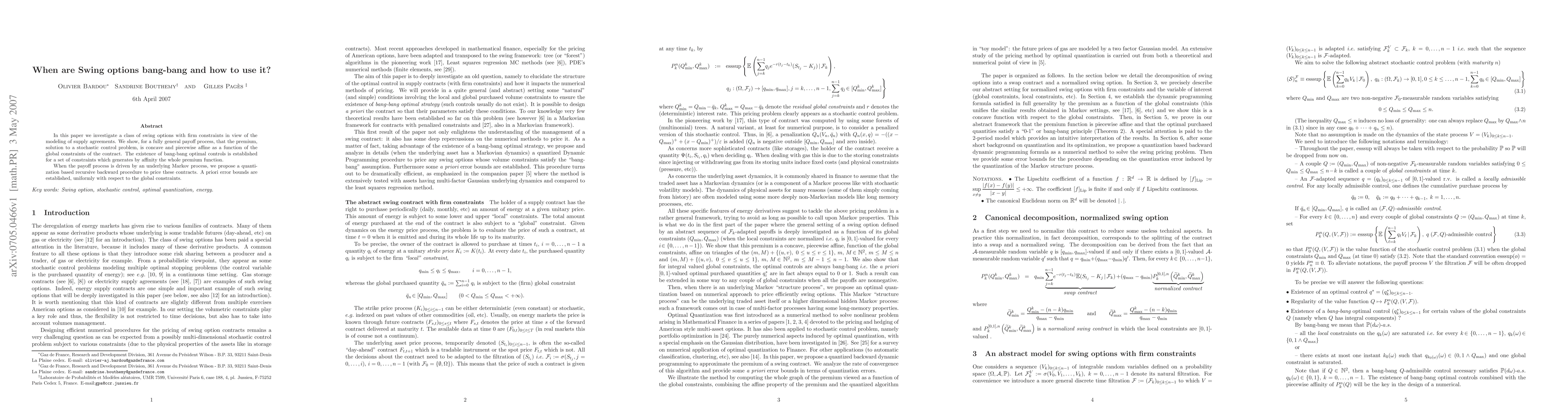

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)