Authors

Summary

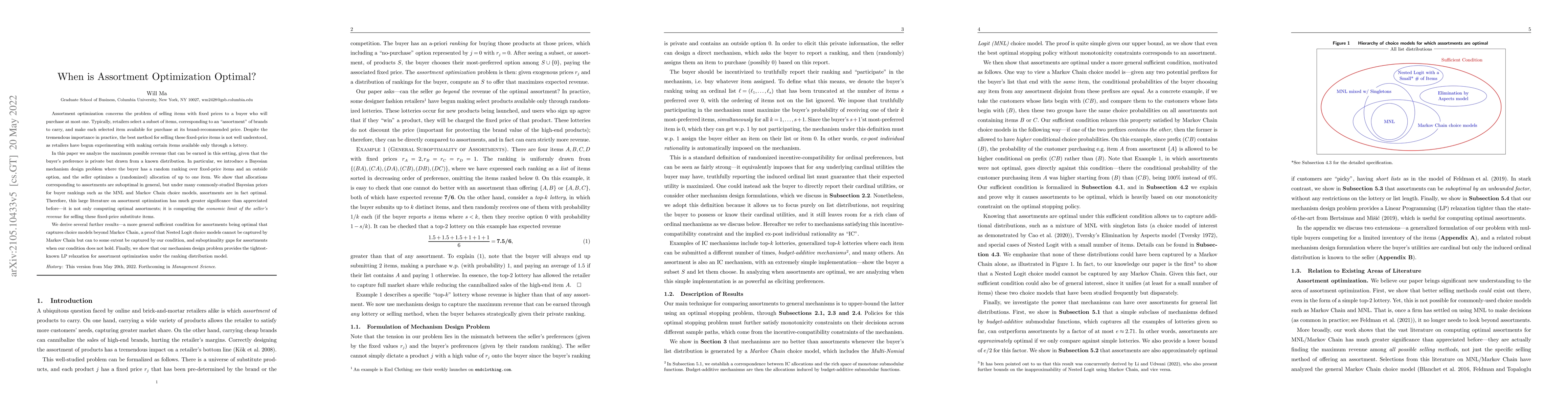

Assortment optimization concerns the problem of selling items with fixed prices to a buyer who will purchase at most one. Typically, retailers select a subset of items, corresponding to an "assortment" of brands to carry, and make each selected item available for purchase at its brand-recommended price. Despite the tremendous importance in practice, the best method for selling these fixed-price items is not well understood, as retailers have begun experimenting with making certain items available only through a lottery. In this paper we analyze the maximum possible revenue that can be earned in this setting, given that the buyer's preference is private but drawn from a known distribution. In particular, we introduce a Bayesian mechanism design problem where the buyer has a random ranking over fixed-price items and an outside option, and the seller optimizes a (randomized) allocation of up to one item. We show that allocations corresponding to assortments are suboptimal in general, but under many commonly-studied Bayesian priors for buyer rankings such as the MNL and Markov Chain choice models, assortments are in fact optimal. Therefore, this large literature on assortment optimization has much greater significance than appreciated before -- it is not only computing optimal assortments; it is computing the economic limit of the seller's revenue for these fixed-price substitute items. We derive several further results -- a more general sufficient condition for assortments being optimal that captures choice models beyond Markov Chain, a proof that Nested Logit choice models cannot be captured by Markov Chain but can be partially captured by our condition, and suboptimality gaps for assortments when our condition does not hold. Finally, we show that our mechanism design problem provides the tightest-known LP relaxation for assortment optimization under the ranking distribution model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPASTA: Pessimistic Assortment Optimization

Vahid Tarokh, Zhengling Qi, Cong Shi et al.

Learning an Optimal Assortment Policy under Observational Data

Jose Blanchet, Han Zhong, Zhengyuan Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)