Summary

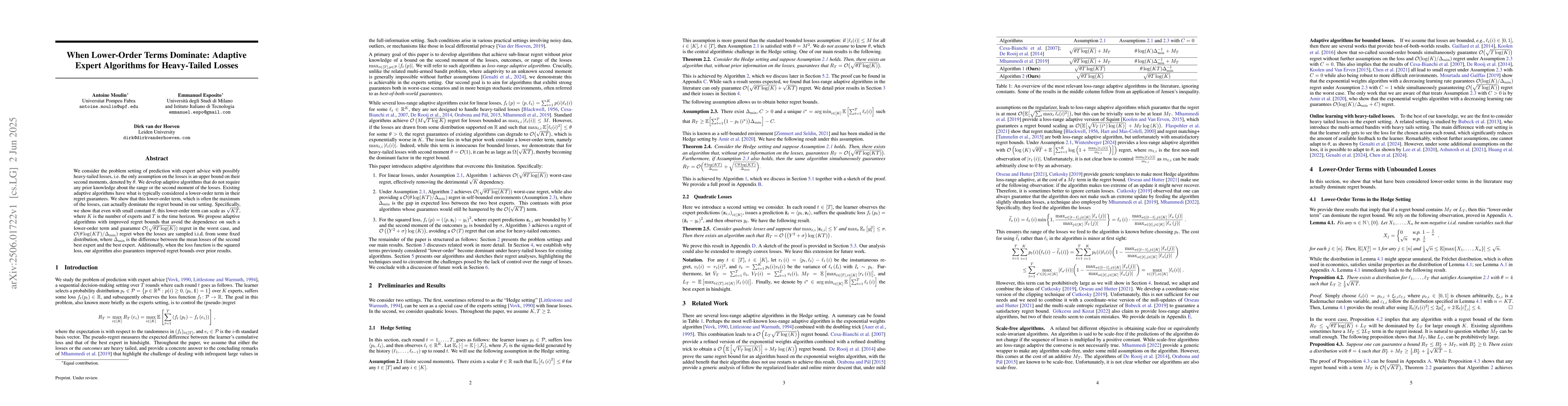

We consider the problem setting of prediction with expert advice with possibly heavy-tailed losses, i.e.\ the only assumption on the losses is an upper bound on their second moments, denoted by $\theta$. We develop adaptive algorithms that do not require any prior knowledge about the range or the second moment of the losses. Existing adaptive algorithms have what is typically considered a lower-order term in their regret guarantees. We show that this lower-order term, which is often the maximum of the losses, can actually dominate the regret bound in our setting. Specifically, we show that even with small constant $\theta$, this lower-order term can scale as $\sqrt{KT}$, where $K$ is the number of experts and $T$ is the time horizon. We propose adaptive algorithms with improved regret bounds that avoid the dependence on such a lower-order term and guarantee $\mathcal{O}(\sqrt{\theta T\log(K)})$ regret in the worst case, and $\mathcal{O}(\theta \log(KT)/\Delta_{\min})$ regret when the losses are sampled i.i.d.\ from some fixed distribution, where $\Delta_{\min}$ is the difference between the mean losses of the second best expert and the best expert. Additionally, when the loss function is the squared loss, our algorithm also guarantees improved regret bounds over prior results.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research develops adaptive algorithms for the prediction with expert advice problem under possibly heavy-tailed losses, assuming only an upper bound on the second moments of the losses (denoted by $\theta$) without prior knowledge of the loss range or second moments.

Key Results

- Proposed adaptive algorithms avoid dependence on a lower-order term (maximum of losses) in regret guarantees.

- Regret bounds improved to $\mathcal{O}(\sqrt{\theta T\log(K)})$ in the worst case and $\mathcal{O}(\theta \log(KT)/\Delta_{\min})$ when losses are i.i.d. from a fixed distribution, with $\Delta_{\min}$ being the difference between the mean losses of the second best and best experts.

- Improved regret bounds for the squared loss function.

Significance

This research is significant as it addresses the issue of heavy-tailed losses in prediction with expert advice, providing adaptive algorithms with better regret guarantees, which are crucial for practical applications where loss distributions may not follow standard assumptions.

Technical Contribution

The main technical contribution lies in the development of novel adaptive expert algorithms that achieve improved regret bounds by avoiding dependence on lower-order terms in heavy-tailed loss settings.

Novelty

This work stands out by highlighting the dominance of lower-order terms in regret bounds for heavy-tailed losses and proposing algorithms to circumvent this issue, offering tighter bounds than existing adaptive methods.

Limitations

- The paper does not explore the performance of the proposed algorithms under more complex loss distributions beyond heavy-tailed and i.i.d. cases.

- Limited discussion on computational complexity and scalability of the proposed methods for very large-scale problems.

Future Work

- Investigate the applicability of these algorithms to more complex loss distributions and non-stationary environments.

- Explore the computational efficiency and scalability of the proposed methods for big data scenarios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)