Summary

Within the context of capital adequacy, we study comonotonicity of risk measures in terms of the primitives of the theory: acceptance sets and eligible, or reference, assets. We show that comonotonicity cannot be characterized by the properties of the acceptance set alone and heavily depends on the choice of the eligible asset. In fact, in many important cases, comonotonicity is only compatible with risk-free eligible assets. The incompatibility with risky eligible assets is systematic whenever the acceptability criterion is based on Value at Risk or any convex distortion risk measure such as Expected Shortfall. These findings qualify and arguably call for a critical appraisal of the meaning and the role of comonotonicity within a capital adequacy context.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

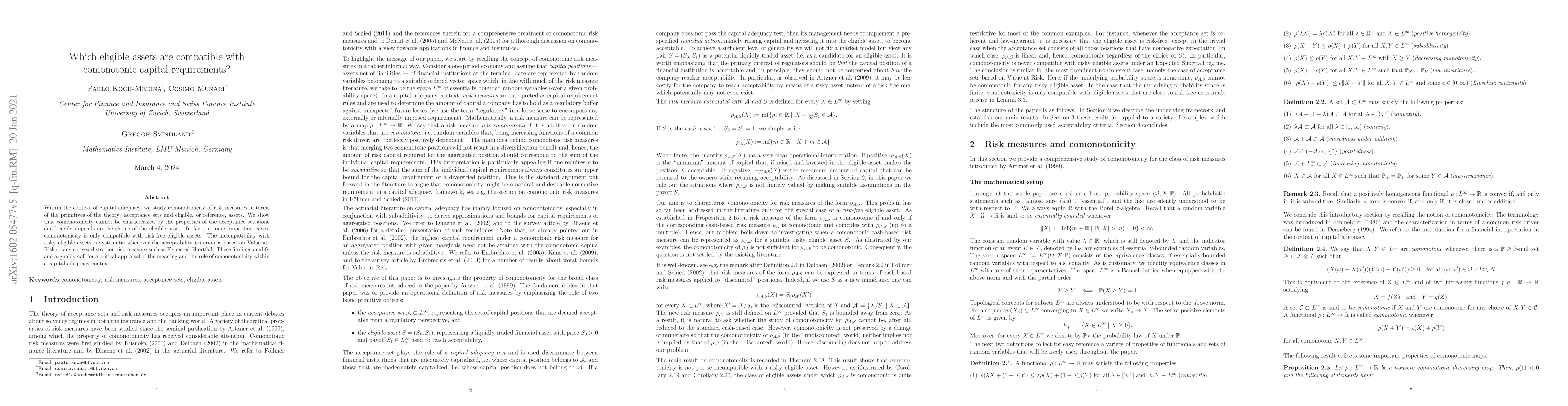

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)