Summary

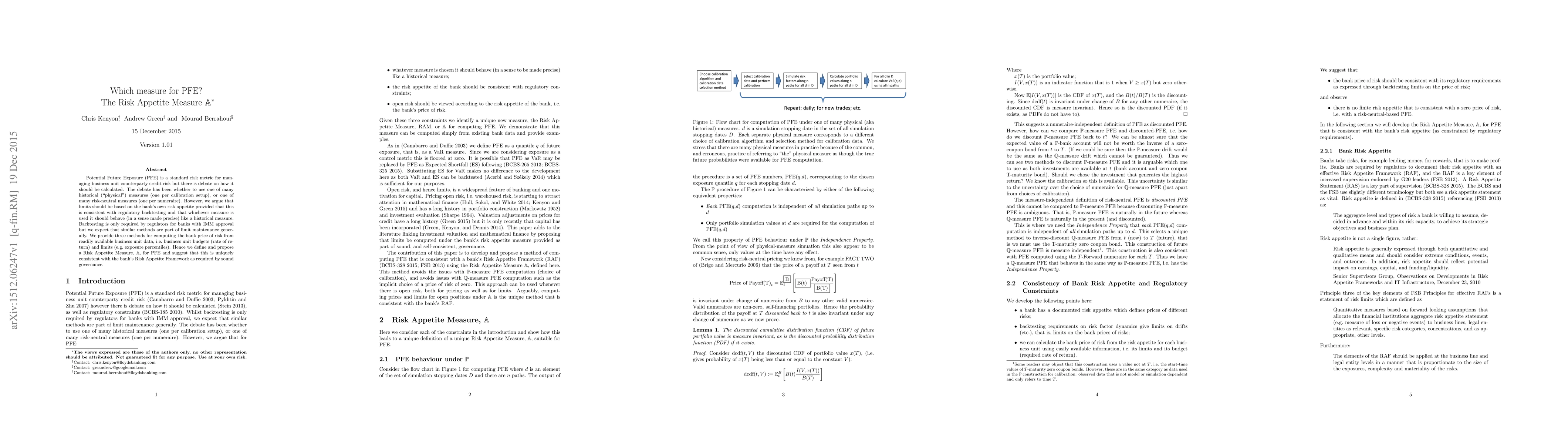

Potential Future Exposure (PFE) is a standard risk metric for managing business unit counterparty credit risk but there is debate on how it should be calculated. The debate has been whether to use one of many historical ("physical") measures (one per calibration setup), or one of many risk-neutral measures (one per numeraire). However, we argue that limits should be based on the bank's own risk appetite provided that this is consistent with regulatory backtesting and that whichever measure is used it should behave (in a sense made precise) like a historical measure. Backtesting is only required by regulators for banks with IMM approval but we expect that similar methods are part of limit maintenance generally. We provide three methods for computing the bank price of risk from readily available business unit data, i.e. business unit budgets (rate of return) and limits (e.g. exposure percentiles). Hence we define and propose a Risk Appetite Measure, A, for PFE and suggest that this is uniquely consistent with the bank's Risk Appetite Framework as required by sound governance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk ratio, odds ratio, risk difference... Which causal measure is easier to generalize?

Gaël Varoquaux, Julie Josse, Erwan Scornet et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)